Monopoly enterprises function within markets characterized by minimal or non-existent competition. These firms dominate their respective sectors, holding a substantial market presence. The stocks associated with such monopolistic companies are often called monopoly stocks.

Opting to invest in monopoly stocks presents a compelling opportunity, as these companies are unlikely to cede their revenue to rival firms. They maintain a firm grip on market share, exhibit robust pricing power, and consistently generate profits. In India, there are a number of companies that enjoy a monopoly position in their respective industries. This blog will explore how companies with strong economic moats and fundamentals are attractive investments for smart investors.

1. IRCTC

Indian Railway Catering and Tourism Corporation (IRCTC) is a public sector undertaking (PSU) under the Ministry of Railways, Government of India. It is the only entity authorized to provide online railway tickets, catering services to railways, and packaged drinking water at railway stations and trains in India.

IRCTC was incorporated on 27 September 1999, and it has since become one of the largest e-commerce companies in India. It is also a profit-making PSU, and it has been consistently paying dividends to its shareholders.

IRCTC’s business segment:

- Ticketing: IRCTC is the only authorized entity to sell online railway tickets in India. It also sells tickets through its mobile app and offline counters at railway stations.

- Catering: IRCTC provides catering services to railways through its pantry cars in trains and food stalls at railway stations.

- Tourism: IRCTC promotes and sells domestic and international tourism packages.

- Packaged drinking water: IRCTC sells packaged drinking water under the brand name Rail Neer at railway stations and trains.

Financial Performance:

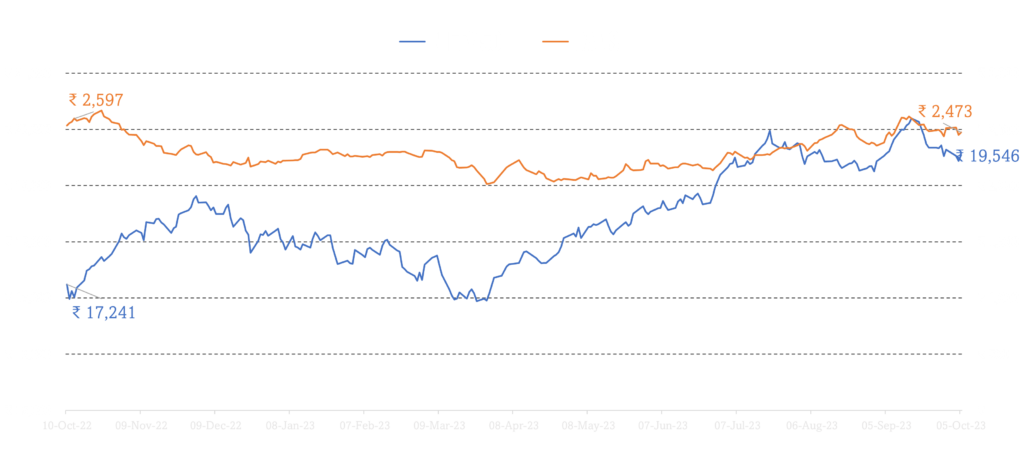

IRCTC has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, IRCTC reported revenue of Rs. 5,863 crores and profit after tax of Rs. 1,848 crores. IRCTC has a strong balance sheet with a debt-to-equity ratio of 0.08x. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The Indian railway industry is expected to grow significantly in the coming years. This is due to a number of factors, including the government’s focus on developing the railway infrastructure and the increasing demand for travel from the growing middle class.

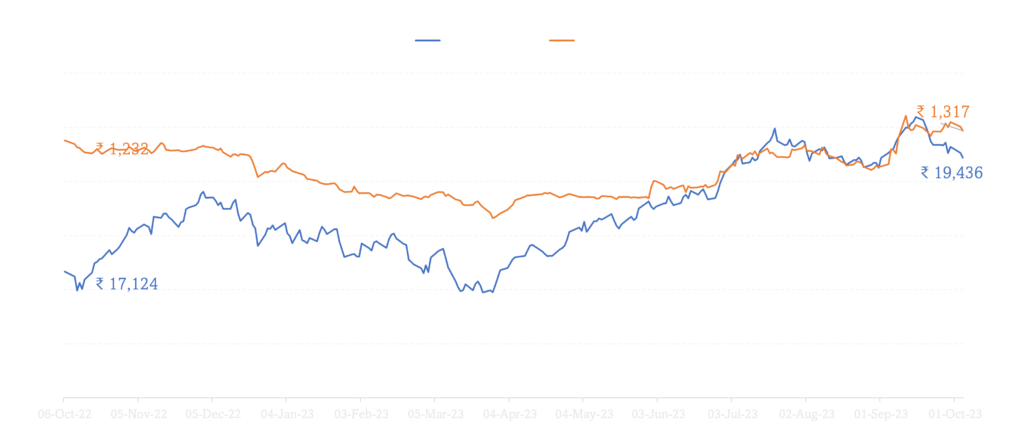

2. HAL

Hindustan Aeronautics Limited (HAL) is an Indian state-owned aerospace and defence manufacturer headquartered in Bangalore, India. Established on 23 December 1940, HAL is one of the oldest and largest aerospace and defence manufacturers in the world. HAL designs, develops, manufactures, repairs and maintains aircraft, helicopters, aero engines, avionics, accessories and aerospace equipment. It also provides related services such as overhaul and upgrade of aircraft and aero engines.

HAL’s business segment:

- Aircraft: HAL manufactures a wide range of aircraft, including fighter jets, transport aircraft, helicopters, and trainers. Some of HAL’s most popular aircraft include the Sukhoi Su-30MKI, the Tejas light combat aircraft, the HAL Dhruv helicopter, and the HAL LCH attack helicopter.

- Aero engines: HAL manufactures a range of aero engines, including jet engines, turboprop engines, and turboshaft engines. Some of HAL’s most popular aero engines include the HAL Kaveri turbofan engine and the HAL Shakti turboprop engine.

- Avionics: HAL manufactures a range of avionics systems, such as radars, navigation systems, and communication systems. Some of HAL’s most popular avionics systems include the AESA radar for the Tejas light combat aircraft and the integrated navigation system for the HAL Dhruv helicopter.

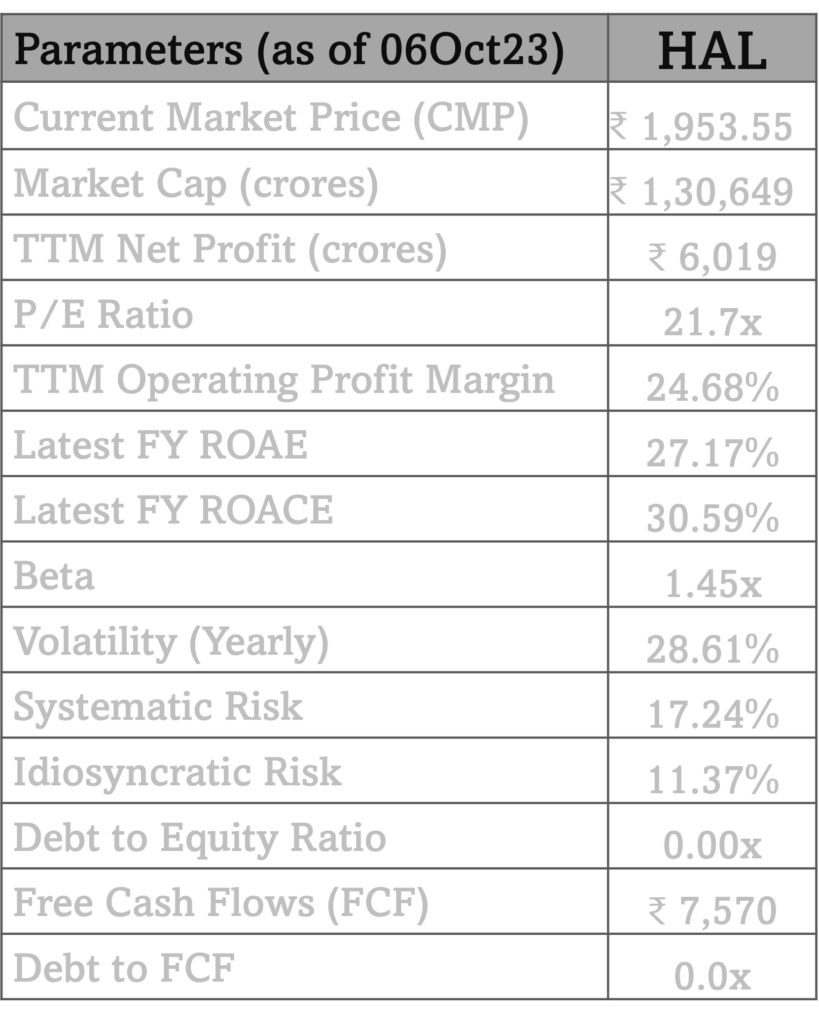

Financial Performance:

HAL has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, HAL reported revenue of Rs. 26,928 crore and profit after tax of Rs. 5,811 crore. HAL has a strong balance sheet with a debt-to-equity ratio of 0.16. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The Indian aerospace and defence industry is expected to grow significantly in the coming years. This is due to a number of factors, including the government’s focus on modernizing the Indian armed forces and the increasing demand for civil aviation in India.

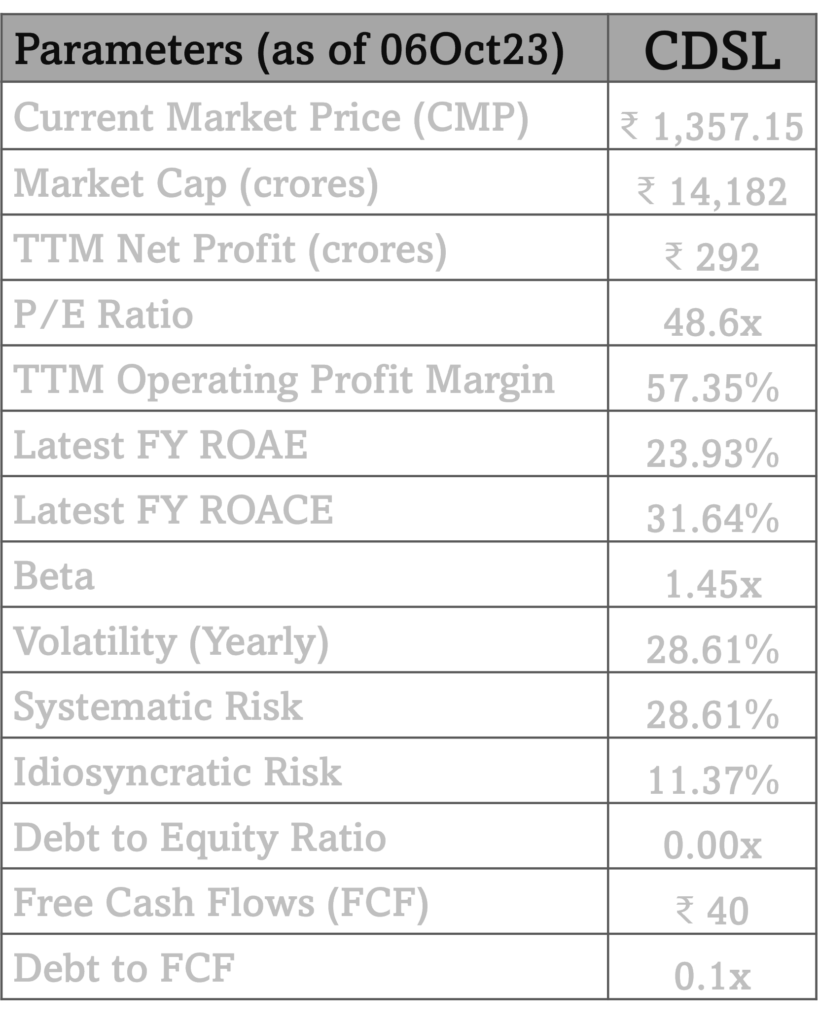

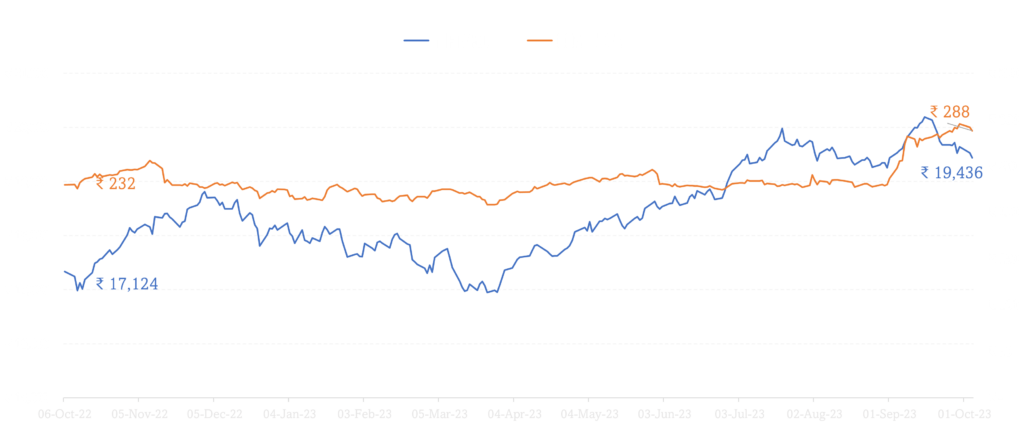

3. CDSL

Central Depository Services Limited (CDSL) is a central securities depository in India. It is a market infrastructure institution (MII) that provides depository services to investors and market participants. CDSL was founded in 1999 and is the largest depository in India in terms of number of demat accounts opened.

CDSL holds a monopoly in the Indian central securities depository market, with a market share of over 70%. The other central securities depository in India is National Securities Depository Limited (NSDL), which has a market share of around 30%.

CDSL’s business segment:

- Dematerialization and rematerialization of securities: CDSL dematerializes securities (i.e., converts them into electronic form) and holds them in a central depository. This eliminates the need for physical certificates and makes it easier to trade and settle securities.

- Settlement of trades: CDSL settles trades on behalf of its members (i.e., brokers and other financial institutions). This helps to reduce the risk of settlement failure and ensures that transactions are completed smoothly.

- Corporate actions processing: CDSL processes corporate actions on behalf of its members. This includes events such as stock splits, mergers, and acquisitions.

- Investor services: CDSL provides a range of investor services, such as access to account statements and online trading.

Financial Performance:

CDSL has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, CDSL reported revenue of Rs. 1,421 crore and profit after tax of Rs. 925 crore. CDSL has a strong balance sheet with a debt-to-equity ratio. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The Indian capital market is expected to grow significantly in the coming years. This is due to a number of factors, including the government’s focus on promoting financial inclusion and the increasing participation of retail investors in the market.

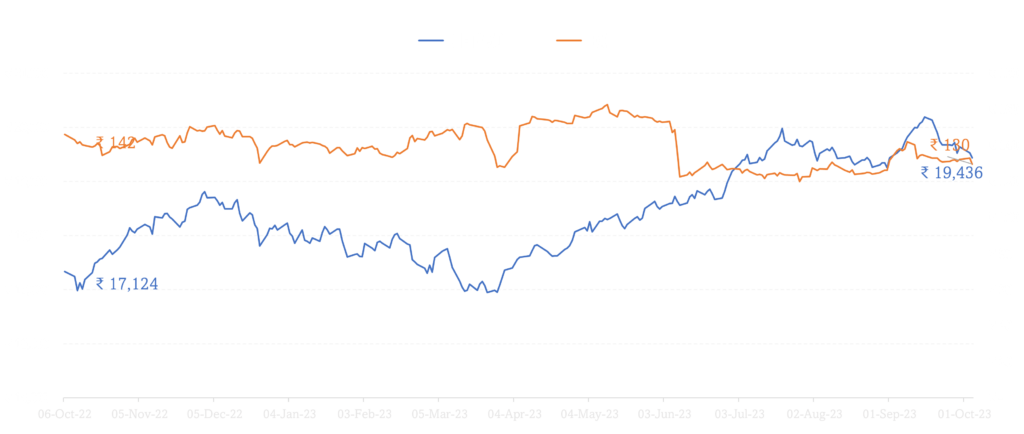

4. Coal India

Coal India Limited (CIL) is the world’s largest coal mining company by production. It is a state-owned enterprise under the Ministry of Coal, Government of India. CIL produces around 82% of the total coal produced in India and accounts for over 70% of the country’s coal reserves.

CIL has a network of over 800 mines spread across eight states in India. The company produces a variety of coal grades, including coking coal, semi-coking coal, and non-coking coal. CIL’s coal is used for a variety of purposes, including power generation, steelmaking, and cement production.

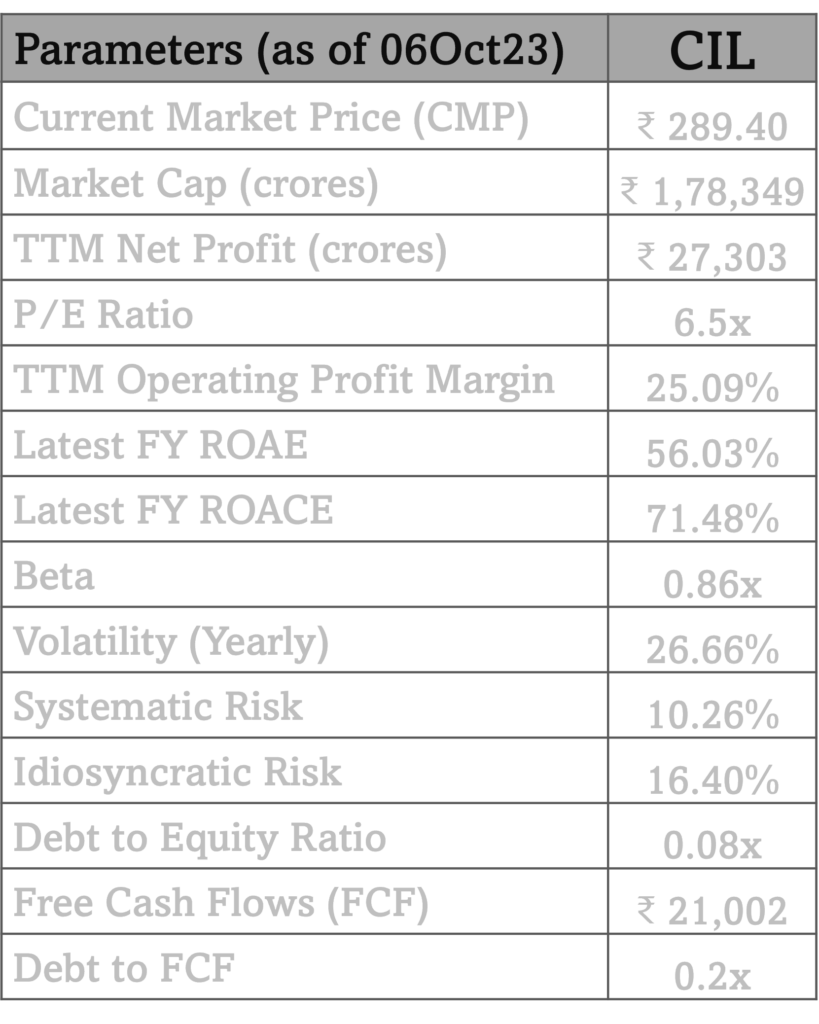

Financial Performance:

CIL has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, CIL reported revenue of Rs. 1,91,892 crore and profit after tax of Rs. 40,528 crore. CIL has a strong balance sheet with a debt-to-equity ratio of 0.14. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The Indian coal industry is expected to grow steadily in the coming years. This is due to a number of factors, including the increasing demand for coal from the power sector and the growing Indian economy.

5. IEX

Indian Energy Exchange (IEX) is a leading energy exchange in India. It is a national level, electronic exchange platform for trading of electricity, renewable energy and carbon credits. The exchange commenced its operations in June 2008. IEX is headquartered in New Delhi.

IEX’s business segment:

- Day-Ahead Market (DAM): DAM is the primary market for trading of electricity on IEX. It is a continuous trading market where participants can buy and sell electricity for the next day delivery.

- Term Ahead Market (TAM): TAM is a market for trading of electricity for future delivery. It is a bilateral contracting market where participants can buy and sell electricity for a specific period of time in the future.

- Real Time Market (RTM): RTM is a market for trading of electricity for real-time delivery. It is a continuous trading market where participants can buy and sell electricity for immediate delivery.

- Green Term Ahead Market (G-TAM): G-TAM is a market for trading of renewable energy certificates (RECs) for future delivery. It is a bilateral contracting market where participants can buy and sell RECs for a specific period of time in the future.

Financial Performance:

IEX has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, IEX reported revenue of Rs. 1,228 crore and profit after tax of Rs. 567 crore. IEX has a strong balance sheet with a debt-to-equity ratio of 0.01. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The Indian power sector is expected to grow significantly in the coming years. This is due to a number of factors, including the increasing demand for electricity from the industrial and commercial sectors, as well as the government’s focus on developing the renewable energy sector.

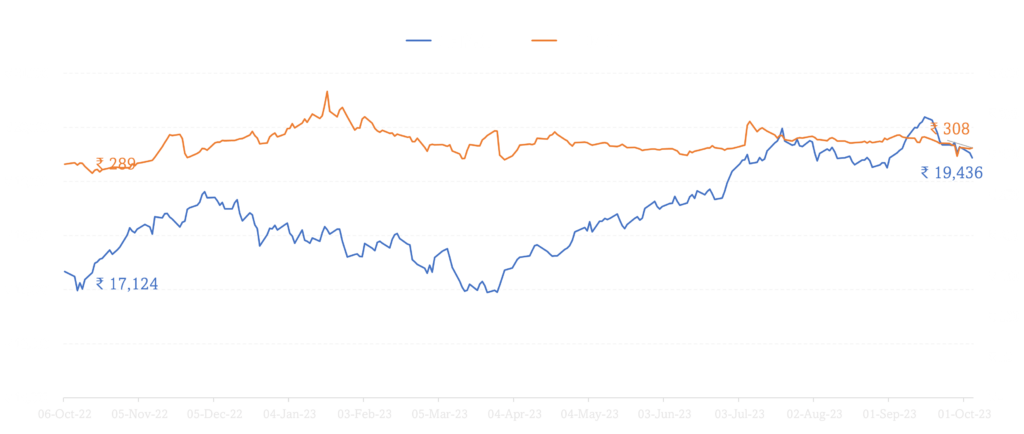

6. Hindustan Zinc

Hindustan Zinc Limited (HZL) is India’s largest and the world’s second largest integrated zinc-lead-silver producer. It is a subsidiary of Vedanta Limited, which owns 64.9% stake in the Company while the Government of India retains a 29.5% stake. HZL’s operations comprise lead-zinc mines, hydrometallurgical zinc smelters, lead smelters, pyro metallurgical lead-zinc smelter as well as sulphuric acid and captive power plants in northwest India. Total metal production capacity is 1.123 Mt.

HZL is a vertically integrated company with a strong track record of operational and financial performance. The company has a robust reserve base of 460.1 million tonnes and an average zinc-lead grade of 6.8%, which ensures a long mine life. HZL also has a strong competitive advantage due to its low-cost operations and efficient supply chain.

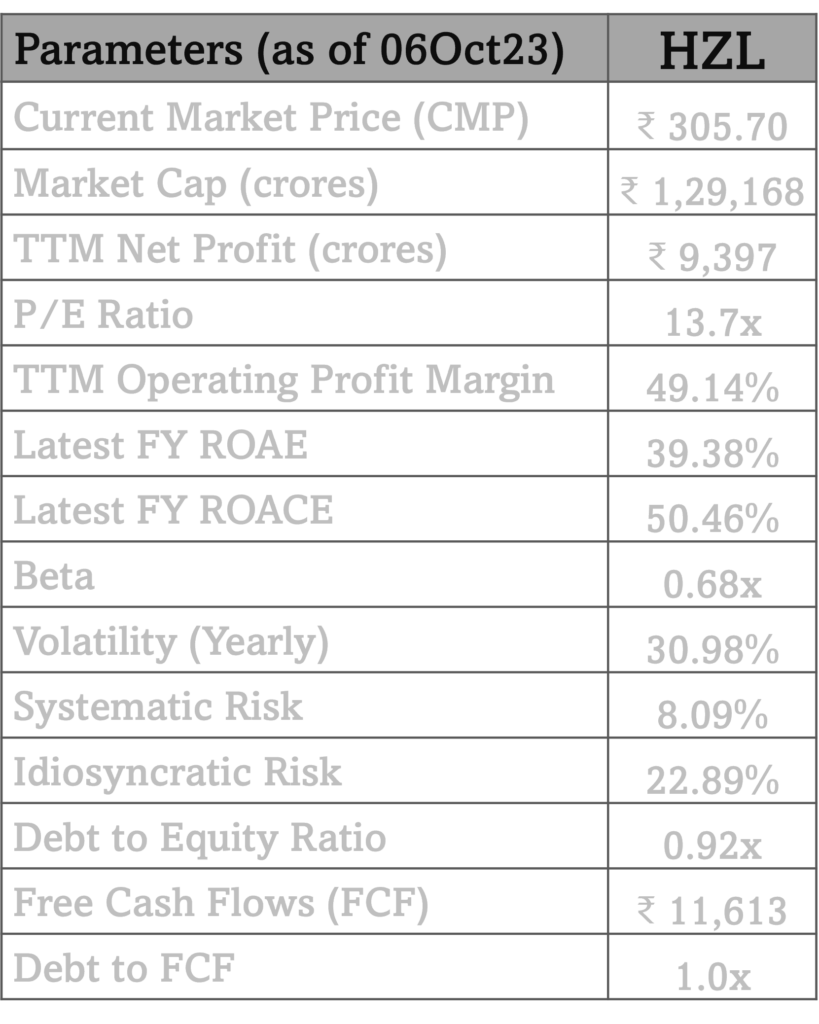

Financial Performance:

HZL has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, HZL reported revenue of Rs. 34,098 crore and profit after tax of Rs. 10,511 crore. HZL has a strong balance sheet with a debt-to-equity ratio of 0.92. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The global zinc market is expected to grow steadily in the coming years. This is due to a number of factors, including the increasing demand for zinc from the construction, automotive, and consumer electronics industries.

7. CAMS

CAMS (Computer Age Management Services) is India’s largest registrar and transfer agent (RTA) for mutual funds. It is a publicly listed company and is headquartered in Mumbai, India. CAMS provides a range of services to mutual funds, including account opening, maintenance, and redemption, as well as dividend distribution and transaction processing.

CAMS was established in 1988 by Karvy Consultants and Karvy Computers. The company started its operations with a single mutual fund, but it has since grown to become the largest RTA in India. CAMS currently services over 22 mutual funds and over 100 million investor accounts.

CAMS’s business segment:

- Registrar and transfer agent services: CAMS provides a range of RTA services to mutual funds, including account opening, maintenance, and redemption, as well as dividend distribution and transaction processing.

- Technology solutions: CAMS provides technology solutions to mutual funds, including online transaction processing systems, mobile apps, and web portals.

- Investor education: CAMS provides investor education programs to help investors understand mutual funds and the investment process.

Financial Performance:

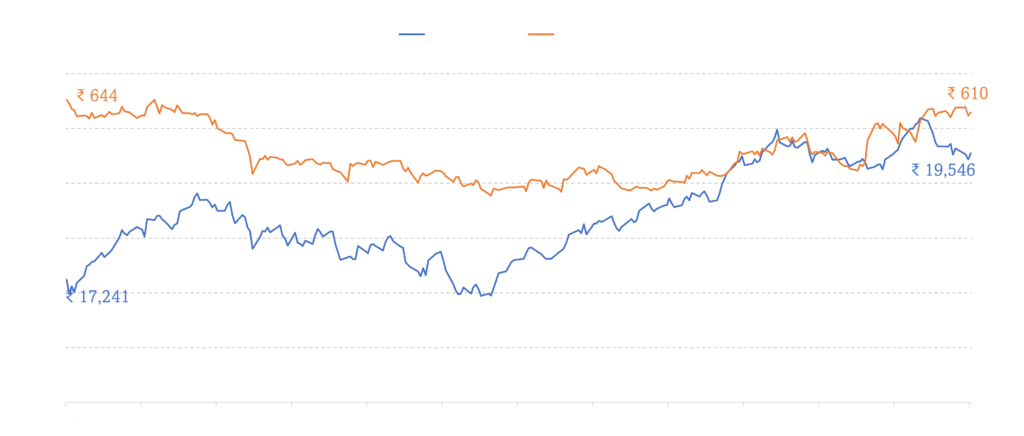

CAMS has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, CAMS reported revenue of Rs. 674 crore and profit after tax of Rs. 219 crore. CAMS has a strong balance sheet with a debt-to-equity ratio. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The Indian mutual fund industry is expected to grow significantly in the coming years. This is due to a number of factors, including the increasing demand for mutual funds from retail investors and the government’s focus on promoting financial inclusion.

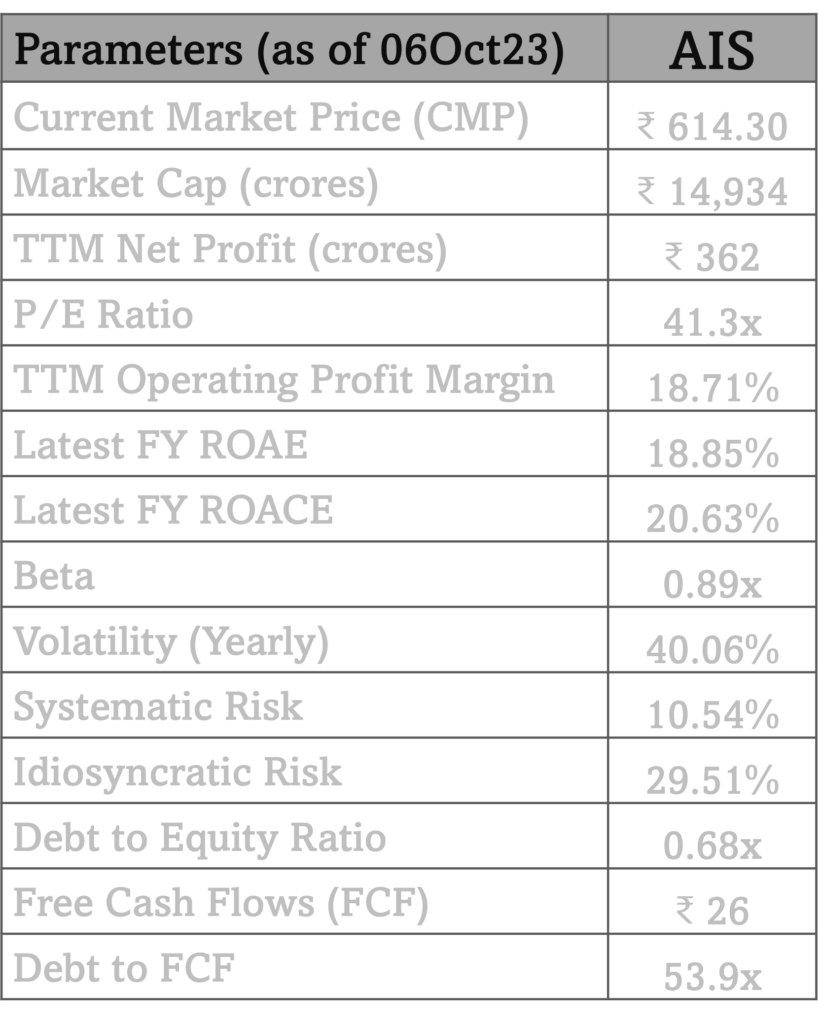

8. AIS

Asahi India Glass Limited (AIS) is India’s largest integrated glass and windows solutions company and a dominant player both in the automotive and the building & construction segments. Its product solutions spanning the entire breadth of automotive, building & construction, and consumer glass, are designed to deliver aesthetics and functional benefits.

AIS is a joint venture between Asahi Glass Co., Ltd. (AGC), Japan, and Maruti Suzuki India Limited (MSIL). AIS was established in 1986 and has grown to become a world-class glass manufacturing company with 13 plants/sub-assembly units and global customers, offering a comprehensive range of products and solutions ranging from Clear & Tinted, to Reflective, Processed, Frosted and Lacquered Glass to Glass Consultation, Installation and Service.

AIS is a leader in the Indian glass industry and is known for its high-quality products and services. The company has a strong track record of innovation and has introduced a number of new products and technologies to the Indian market. AIS is also committed to sustainability and has adopted a number of measures to reduce its environmental impact.

AIS’s business segment:

- Automotive glass: AIS is a leading manufacturer of automotive glass in India. The company supplies automotive glass to all major car manufacturers in India.

- Building and construction glass: AIS is a leading manufacturer of building and construction glass in India. The company supplies building and construction glass to a wide range of customers, including builders, developers, and architects.

- Consumer glass: AIS is a leading manufacturer of consumer glass in India. The company supplies consumer glass to a wide range of customers, including households, restaurants, and hotels.

Financial Performance:

AIS has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, AIS reported revenue of Rs. 12,456 crore and profit after tax of Rs. 2,011 crore. AIS has a strong balance sheet with a debt-to-equity ratio of 0.31. The company has also been generating healthy cash flows from its operations..

Industry Outlook:

The Indian glass industry is expected to grow significantly in the coming years. This is due to a number of factors, including the increasing demand for glass from the automotive, building and construction, and consumer goods industries.

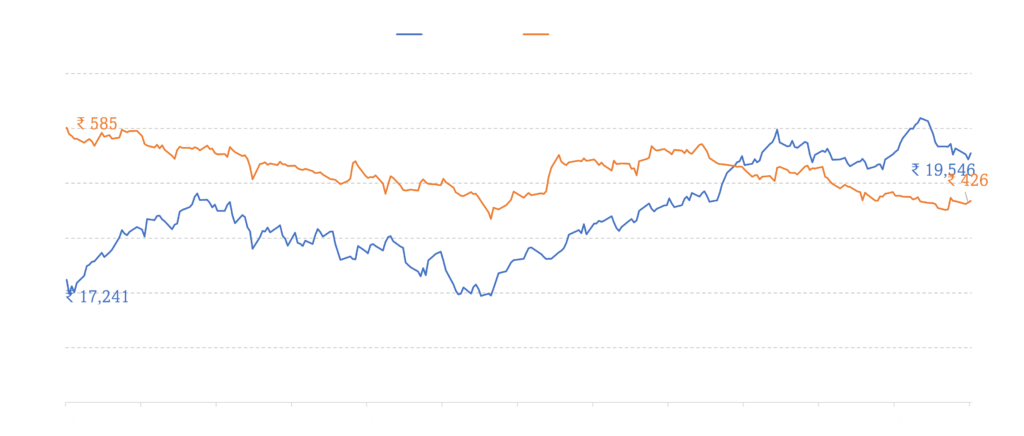

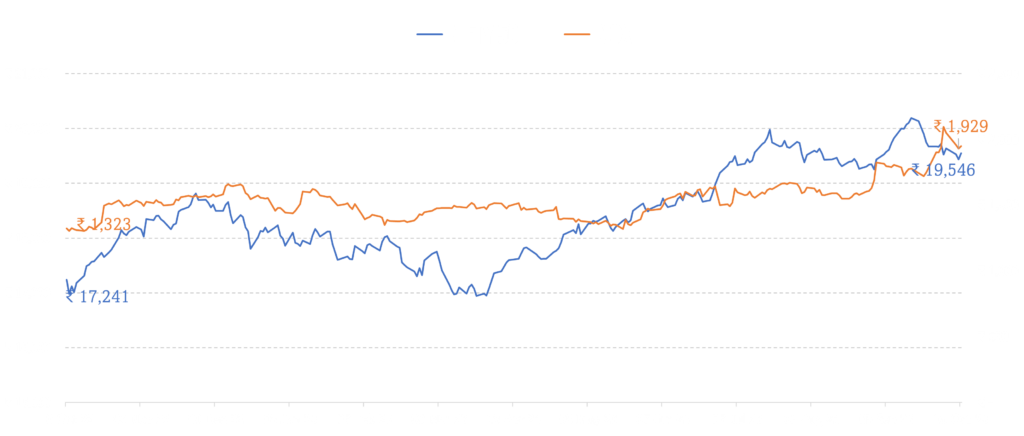

9. Borosil Renewables

Borosil Renewables Limited (BRL) is India’s first and only solar glass manufacturer. It is a part of the Borosil group which is well-known for the brand “BOROSIL®” that manufactures a range of lab ware, scientific ware, and consumer ware products.

BRL was established in 1962 and has been manufacturing solar glass since 2010. The company has a manufacturing facility in Bharuch, Gujarat, with a capacity of 450 tonnes per day (TPD). BRL is planning to expand its capacity to 1,000 TPD by 2024-25.

BRL’s solar glass is used in the manufacturing of solar panels. The company’s solar glass is known for its high quality and durability. BRL’s solar glass is also resistant to corrosion and UV radiation. RL’s customers include leading solar panel manufacturers in India and overseas. The company exports its solar glass to over 30 countries.

BRL is a well-established company with a strong track record of growth. The company is well-positioned to benefit from the growing demand for solar energy in India and around the world.

BRL’s business segment:

- Solar glass manufacturing: BRL is a leading manufacturer of solar glass in India. The company’s solar glass is used in the manufacturing of solar panels.

- Research and development: BRL invests heavily in research and development. The company is constantly developing new and innovative solar glass products.

- Sustainability: BRL is committed to sustainability. The company uses renewable energy to power its manufacturing facility. BRL is also working to reduce its environmental impact.

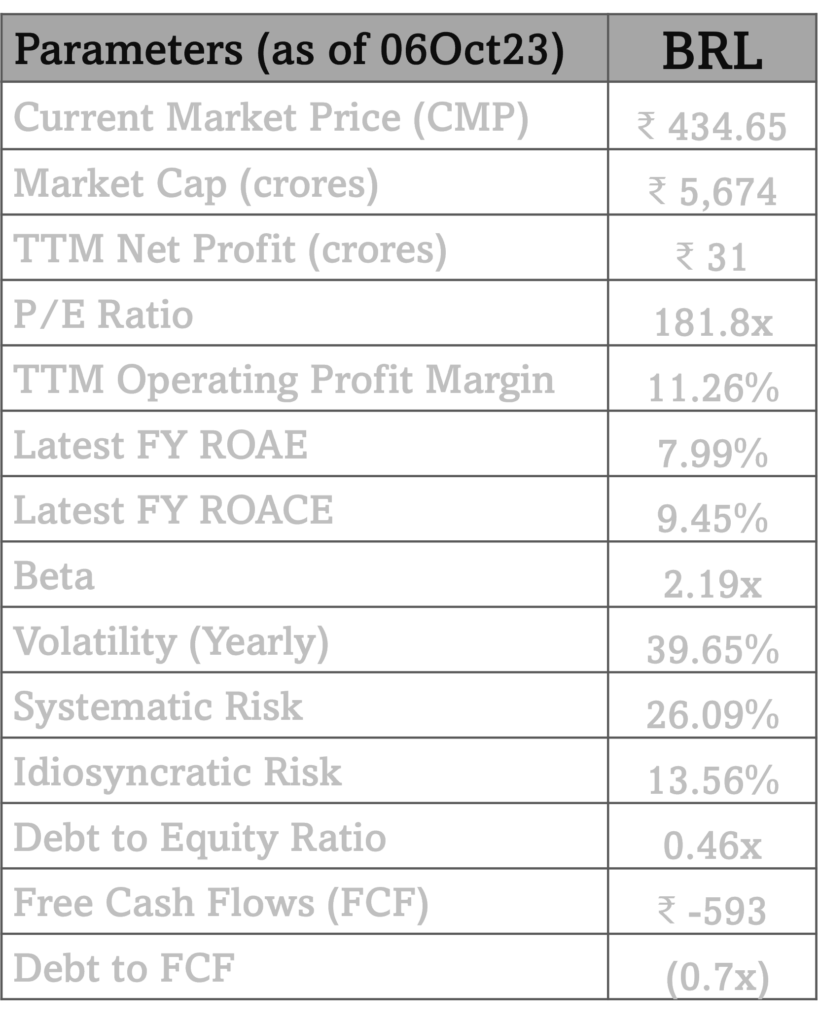

Financial Performance:

BRL has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, BRL reported revenue of Rs. 928 crore and profit after tax of Rs. 237 crore. BRL has a strong balance sheet with a debt-to-equity ratio of 0.53. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The global solar energy market is expected to grow significantly in the coming years. This is due to a number of factors, including the declining cost of solar panels, government incentives for solar energy, and increasing awareness about climate change.

10. MCX

The Multi Commodity Exchange of India Limited (MCX) is India’s largest commodity derivatives exchange. It was established in 2003 and is headquartered in Mumbai, India. MCX offers trading in a wide range of commodities, including bullion, base metals, energy, and agricultural products.

MCX plays an important role in the Indian economy by providing a platform for price discovery and risk management for market participants. It also helps to attract foreign investment into the Indian commodity sector. MCX is a leading commodity exchange in India that plays a vital role in the Indian economy. It provides a transparent, efficient, and competitive platform for trading of commodities

MCX is a member of the World Federation of Exchanges (WFE) and the Federation of Indian Chambers of Commerce and Industry (FICCI). It is also regulated by the Securities and Exchange Board of India (SEBI).

MCX’s Key Products:

- Bullion: Gold, silver, and platinum

- Base metals: Copper, lead, zinc, aluminum, and nickel

- Energy: Crude oil, natural gas, and petroleum products

- Agricultural products: Cotton, soybeans, wheat, corn, and guar seed

Financial Performance:

MCX has a strong track record of financial performance. The company has been consistently generating revenue and profit growth. In the financial year 2022-23, MCX reported revenue of Rs. 1,045 crore and profit after tax of Rs. 581 crore. MCX has a strong balance sheet with a debt-to-equity ratio of 0.36. The company has also been generating healthy cash flows from its operations.

Industry Outlook:

The Indian commodity derivatives market is expected to grow significantly in the coming years. This is due to a number of factors, including the increasing demand for commodities from the industrial and commercial sectors, as well as the government’s focus on developing the commodity sector.

Learning how to invest in high-quality stocks is a valuable skill that can help you achieve your financial goals. However, it can be a complex and daunting task, especially for beginners.

The Hybrid Investing Masterclass is a comprehensive 3 Hours Masterclass that can teach you everything you need to know about investing in high-quality stocks. The course covers a wide range of topics, including:

- What are High-quality stocks?

- How to identify High-quality stocks

- How to build a diversified portfolio

- How to manage risk

Learn To Build Your Multi-bagger Portfolio Spending Only 15 Minutes Without Finance Knowledge Or Investing Experience Without Losing Your Mind And Money

The masterclass is taught by experienced investment professionals who will share their insights and strategies with you. If you are serious about learning how to invest in high-quality stocks, I highly recommend the Hybrid Investing Masterclass.

Happy investing!

Disclaimer:

This blog/video is for educational purposes only and should not be considered financial advice. It is essential to conduct your own research and consult with a qualified financial advisor before making any investment decisions. Your personal financial situation, risk tolerance, and investment goals are unique, and this content may not be suitable for you. Please make informed decisions based on your specific circumstances and professional guidance.