Join HYBRID INVESTING MASTERCLASS

Through a wide variety of mobile applications.

- Speakers Chandril Ray, FRM, MBA (IIM A), MS

- Date Saturday at 7.55 PM

- Tropic How to learn Fundamental Analysis of Stocks?

- Bonus Rs.16490/- Absolutely Free*

Hello, I'm Saikat Halder, a finance professional holding designations such as FRM, MFA, NISM-V, XV, XXI-A. My mission is to empower individuals with financial knowledge and skills to make informed decisions.

Helping individuals build financial literacy and confidence through comprehensive coaching and training.

Help individuals prepare for the exams by building their knowledge and understanding the relevant financial concepts.

Teach the power of the internet to transform your knowledge into digital and educate business foundation.

Saikat Halder, CFA, FRM, MS Finance, also recognized as the Investment Coach, draws upon a rich 15-year background in investment banking and the financial sector. His extensive knowledge encompasses risk management, investment banking, personal finance, and wealth management. Through the acclaimed ‘Investment Mastery Program,’ he educates learners with valuable insights for a more informed and strategic financial education.

We will educate you rather than provide specific financial advice, and it’s always advisable to consult with a legal or financial professional for personalized guidance.

Through a wide variety of mobile applications.

Through a wide variety of mobile applications.

Experience the power of Investment Mastery Program and unlock a world of opportunities with an incredible bonus offer! Join us today and receive a bonus absolutely free, adding extra value to your investment journey. Don’t wait any longer – reserve your seat within the next 15 minutes to take advantage of this exclusive opportunity and unlock bonuses worth ₹5490. Act now and seize the benefits that await you!.

I am truly impressed with the Learn and Earn concept presented by this platform. The emphasis on understanding fundamentals is remarkable. The incorporation of real market conditions, particularly in the case of individual shares and financial institutions, is highly beneficial. The use of actual facts and figures provides a comprehensive and practical learning experience. The platform's commitment to delivering insights with live market relevance has been instrumental in enhancing my understanding of financial markets.

Hybrid Investing stands out as an exceptional platform, offering aspiring risk management professionals a wealth of invaluable resources and a supportive community to propel their career aspirations and enrich their knowledge. The platform's commitment to fostering a collaborative learning environment has been instrumental in my professional growth, providing me with the tools and insights needed to navigate the complexities of risk management. I highly recommend Hybrid Investing to anyone looking to advance their career in this field and join a community dedicated to continuous learning and development

In one word, the educational experience is exceptional. It surpasses imagination. As of now, I applied the principles learned and purchased 100 stocks of West Coast Paper at Rs. 490.00 in the first week of March '23. Currently, the price stands at Rs. 540.00, an unimaginable increase. This level of return has been unprecedented for me in the last five years. I extend my gratitude to the Hybrid Multibagger class for providing such insightful guidance. I look forward to continuing to receive this type of educational support in the coming days. Thank you for the invaluable lessons.

Saikat's educational approach to investment strategies has been a transformative force in my life. His emphasis on setting clear financial goals and implementing diversification principles has guided me in building a well-balanced portfolio. Through maintaining discipline and patience, I've witnessed steady growth and experienced the magic of compounding in action. Saikat's teachings have not only made me a successful learner but have also empowered me with the knowledge and confidence to navigate the financial markets with ease.

Learn to find multibagger stocks, and maximize 10x returns!

Investor’s Mindsets

Tools and Systems

Fundament of Stock Market

Compounding Effects

Select high-quality stocks

Identify Economic moats

Select undervalued stocks

Optimum Diversification

When to buy and sells

Build multi-baggers Portfolio

Understand the risk

Rebalance time to time

Together, we can create a comprehensive strategy tailored to your needs and goals.

Financial Assessment

Investment Goal Setting

Investment Portfolio Review

Optimum Asset Allocation

Retirement Planning

Tax Efficiency Strategies

Risk Management

Contingency Planning

Debt Management

Financial Guidance

Regular Portfolio Review

Supportive Networks

Leverage your knowledge and creativity to build assets and accelerate to becoming a millionaire 100x faster.

Identify Your Niche

Plan Your Curriculum

Choose the Right Format

Quality Content Creation

Design Customization

Select a Platform

Pricing Strategy

Marketing and Promotion

Collect Testimonials

Engage with Your Audience

Scale and Expand

Collaborate and Network

In recent times, growing tensions between India and Pakistan have led to sharp movements in the stock markets. Many investors are worried, confused, and asking the important question: What happens to the market if India and Pakistan actually go to war?

Let’s break it down logically and calmly.

If a war were to break out, the Indian stock markets would likely see an immediate, sharp fall. Fear and uncertainty cause investors to panic, leading to a sell-off. Historically, during wars or rumors of wars, stock markets react negatively at first because investors rush to safeguard their investments.

However, it’s crucial to note that not every panic leads to a prolonged bear market.

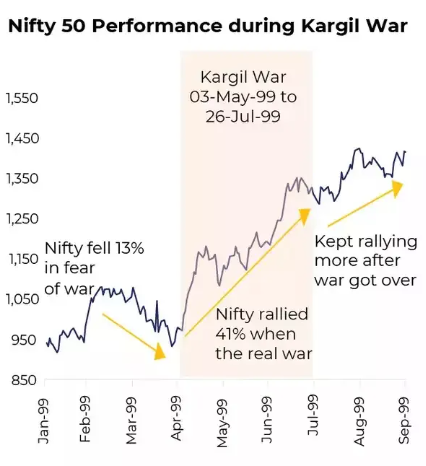

History shows us that markets often bounce back strongly after an initial fall. Whether it was the Kargil War, pandemics, or financial crises, Indian markets have typically followed a V-shaped recovery pattern. Investors who panic and sell during the initial drop often experience FOMO (Fear of Missing Out) once markets recover.

Thus, while the first reaction to war is negative, the medium- to long-term picture can quickly stabilize if the situation doesn’t escalate drastically.

It’s important to differentiate between a direct war (like India-Pakistan) and wars where India is not involved (like Russia-Ukraine). A direct conflict would have a stronger, more adverse impact on Indian markets. Yet, if the skirmishes are limited, the market could recover faster than expected.

Beyond emotions, we must look at economic logic. Pakistan’s total stock market capitalization is around ₹5.25 lakh crore — roughly equivalent to a single large Indian company’s market cap. Warfare is incredibly expensive: missile launches alone can cost lakhs per shot. Considering Pakistan’s struggling economy, sustaining a prolonged conflict seems financially unrealistic.

Thus, a full-fledged, long-term war is highly unlikely from an economic standpoint.

It’s important to differentiate between a direct war (like India-Pakistan) and wars where India is not involved (like Russia-Ukraine). A direct conflict would have a stronger, more adverse impact on Indian markets. Yet, if the skirmishes are limited, the market could recover faster than expected.

The recent correction in the Indian markets isn’t purely because of war fears. After a non-stop rally from 21,800 to over 24,300 in Nifty, a correction was overdue. Healthy corrections are normal in bull markets and should not always be linked to geopolitical tensions.

While war fears are real and should not be dismissed, investors must approach the situation logically. Reacting emotionally by selling stocks can lead to missed opportunities when the market recovers. Historically, India has shown resilience, and barring a major escalation, markets could bounce back stronger than ever.

In times of uncertainty, staying calm, understanding the broader picture, and avoiding panic-driven decisions is the best strategy for any investor.

Financial planning is more than just budgeting or saving money. It’s a holistic approach to managing your finances, setting goals, and creating a roadmap for your financial future. Whether you’re just starting out in your career, preparing for retirement, or aiming to grow your wealth, a comprehensive financial plan is essential. In this guide, we’ll explore the key steps and principles of financial planning to help you build a secure and prosperous future.

At its core, financial planning is about setting and achieving your financial goals through disciplined management of your resources. It involves assessing your current financial situation, defining your objectives, and developing strategies to reach those goals. Let’s break down the components of a comprehensive financial plan:

https://www.youtube.com/watch?v=QXU9tdHJZBA

A comprehensive financial plan is a roadmap to financial well-being. It’s not a one-time task but a dynamic process that evolves with your life changes. Regularly review and adjust your plan as needed to stay on track toward your goals. Remember, financial planning is about making informed decisions today to secure a brighter and more prosperous tomorrow. By following these steps and principles, you can navigate the complexities of personal finance with confidence and build a secure future for yourself and your loved ones.

The Indian stock market is soaring, with the Nifty hitting record highs. This can be thrilling for investors seeking profits, but also nerve-wracking due to potential volatility. To navigate this environment, financial experts recommend a long-term focus, a balanced portfolio with an emphasis on high-quality established companies, strategic profit-taking, and the ability to adapt your strategy as market conditions evolve.

The chart illustrates equity performance across various holding periods, ranging from 5 to 30 years. On the left-hand side, the percentage returns for each period are displayed, indicating an average return of approximately 14% for a 5-year investment in equities. Meanwhile, the right-hand side shows volatility, measured by standard deviation, which decreases as the holding period extends. This implies that longer-term investments in equities experience less volatility compared to shorter terms. The chart suggests that Indian stock market investors can potentially achieve higher returns with extended holding periods, but this comes with the trade-off of enduring higher short-term volatility.

If we examine the graph below, it indicates that equities have typically yielded the highest returns over the long term, albeit with the highest volatility among asset classes. Debt and gold, on the other hand, have historically offered more stable returns but with lower growth potential. Silver appears to be more volatile than gold, potentially offering higher returns. During the time period shown in the chart, the Nifty 50 seems to have underperformed equities. A bullish market strategy involves diversifying with asset classes such as gold, silver, and debt, allocating a portion of the portfolio to each.

The Nifty 50 sector weightage chart, where sectors like Financials hold significant weight. Quality stocks within these sectors, such as established banks with strong fundamentals, can provide stability. Sector rotation, despite the static chart, allows for strategic shifts based on sector performance changes over time. By adjusting holdings to favor outperforming sectors and maintaining quality stocks, investors may aim to mitigate risk and capitalize on market opportunities.

Prioritizing high-quality large-cap stocks for stability involves focusing on companies with established track records, strong financials, and market leadership positions. Large-cap stocks are generally less volatile than small-cap stocks and tend to be more resilient during market downturns. High-quality large caps often have consistent earnings, stable cash flows, and sustainable business models. Investors seeking stability may prioritize these stocks because they tend to weather market fluctuations better and offer more predictable returns over the long term. By emphasizing large-cap stocks with proven stability and quality, investors aim to build a more resilient and reliable portfolio.

Please read this “Unlock Multibagger Potential with These Magic Ratios” to identify High Quality Stocks

The concept of market rebounds emphasizes that stock markets tend to fluctuate over time, with periods of significant growth (bull markets) followed by declines (bear markets). Despite crashes, historical trends show that stock markets tend to recover and surpass previous highs in the long term, although this doesn’t guarantee future performance. This rebound can be attributed to factors such as economic growth, reflected in rising corporate earnings; company improvements in profitability through better management and product development; and overall investor confidence in the market’s potential for growth. Examples include the recovery from the Great Depression in 1929, the Dot-Com Bubble crash in 2000, and the 2008 Financial Crisis. However, recovering from crashes can take years, and there’s always a risk of permanent capital loss. This highlights the importance of a long-term investment strategy and diversification across asset classes to mitigate risk.

In conclusion, as the Indian stock market continues its upward trajectory, investors are advised to adopt a long-term investment approach with strategic adjustments to navigate potential volatility. Embracing quality stocks within sectors like Financials, prioritizing high-quality large caps for stability, and being opportunistic within a rangebound market can help capitalize on market opportunities while mitigating risks. Strategies such as regular portfolio rebalancing, strategic profit-taking, and sector rotation are essential for maintaining a balanced and resilient portfolio. While historical trends suggest market rebounds after downturns, investors should remain vigilant and seek professional advice to tailor their investment strategies to their individual goals and risk tolerance.

Gain financial freedom, escape corporate slavery, and embrace the opportunity to build your financial education all through my step-by-step method.

Phone: +91 70456 53533 Email: connect@saikathalder.com© Copyright 2023- All rights reserved