Many individuals find mutual fund investing confusing due to the overwhelming array of options and complex financial terminology. This confusion arises from a lack of financial product knowledge, leaving investors unsure of where to start. Whether you’re saving for retirement, building an emergency fund, or seeking growth opportunities, we’ll demystify the jargon, explain fund types, and create a personalized investment strategy based on your investment horizon, risk tolerance, and desired returns. In this article, I will be going to discuss the types of mutual funds and the best scheme available that shoots your investment goal. Further, we will share some of the best-performing mutual fund available right now for investment. So, don’t let mutual fund confusion hold you back from financial success; let’s embark on your investment journey today!

Important Concepts in Mutual Funds:

- Units: When investing in a mutual fund, your money is converted into “Units” within the scheme, serving as proof of your investment.

- Face Value: Typically, each unit in a mutual fund has a baseline face value of Rs.10, crucial for accounting purposes.

- Unit Capital: The total capital of a mutual fund scheme is calculated by multiplying the number of units issued by Rs.10 per unit, resulting in the Unit Capital.

- Recurring Expenses: Mutual funds incur ongoing fees or commissions paid to fund managers and other constituents. These expenses are expressed as a percentage of the scheme’s assets under management (AUM) and are deducted when calculating the Net Asset Value (NAV).

- Net Asset Value (NAV): NAV represents the current value of one unit within a mutual fund scheme. It increases with profitable investments and decreases with losses.

- Assets under Management (AUM): AUM signifies the total value of investments made in a mutual fund scheme, providing a comprehensive measure of its financial scale, including all assets.

- Mark to Market (MTM): MTM is the process of valuing each security in a mutual fund’s portfolio at its current market value, ensuring alignment with current market conditions.

Understanding these fundamental terms is essential for anyone considering investing in mutual funds. They provide the groundwork for comprehending the intricacies of mutual fund investments and their associated costs.

To proceed, you must grasp the fund’s structure and management style:

Fund Structure:

- Open-Ended Funds: Offer flexibility for investors to enter or exit anytime, without a fixed closure date.

- Close-Ended Funds: Have predetermined maturity, allowing unit purchase only during the initial offer.

- Interval Funds: Combine traits of open and close-ended schemes, periodically transitioning to open-ended during specific “transaction periods.”

Management Style:

- Actively Managed Funds: Fund managers select investments within the scheme’s objectives, with higher operational costs and expectations of market outperformance.

- Passive Funds: Follow predefined indices, mirroring their performance without aiming to surpass the market.

- Exchange Traded Funds (ETFs): ETFs replicate index portfolios, traded at real-time prices, linked to underlying index changes during the initial offer.

Mutual funds offer a variety of investment options across five primary asset classes: equities, debt, real estate, and alternative investments such as digital currencies and art. Depending on the chosen asset class, investors can select from numerous schemes. In this section, we’ll explore some of the top-performing mutual funds and the best schemes for investment.

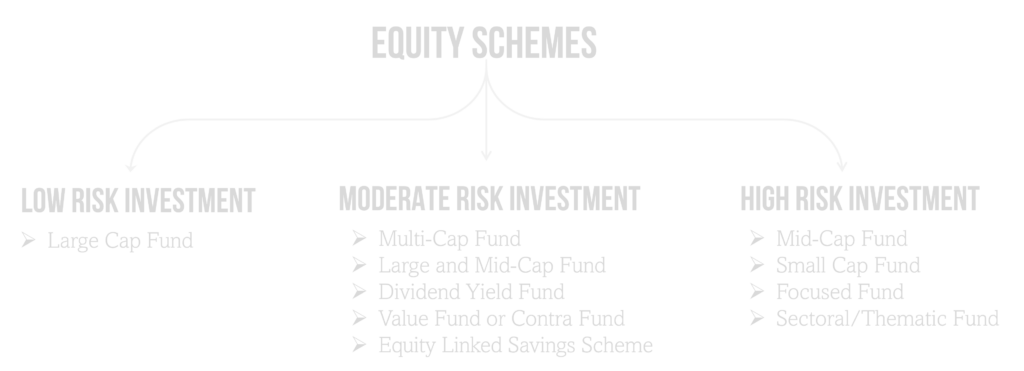

What is Equity Schemes?

Equity schemes, a category of mutual funds, predominantly invest in stocks of publicly traded companies with the primary objective of achieving long-term capital growth for investors. These schemes, managed by experienced fund managers, offer the potential for higher returns, but they are also associated with higher market risk and volatility compared to other asset classes like debt. Equity mutual funds diversify their portfolios across various stocks and may encompass different subcategories based on investment focus, such as large-cap, mid-cap, or sector-specific funds. Investors should carefully consider their risk tolerance and investment goals before opting for equity schemes, which provide liquidity and the opportunity to participate in the growth potential of the stock market.

1. Multi-Cap Fund

Who Should Invest

Investors seeking diversification across different market capitalizations, willing to accept a moderate level of risk.

Time Horizon

Typically, a medium to long-term investment horizon (3-5 years or more) is recommended.

Risk

Moderate risk due to exposure to various market segments; returns can be influenced by market volatility.

An open-ended equity scheme that invests in a diversified portfolio spanning large-cap, mid-cap, and small-cap stocks, with a minimum requirement of 65 percent equity investment.

2. Large Cap Fund

Who Should Invest

Conservative investors looking for stable returns and lower risk.

Time Horizon

A medium to long-term horizon (3-5 years or more) is suitable.

Risk

Lower risk compared to mid-cap and small-cap funds, but still subject to market fluctuations.

An open-ended equity scheme primarily focused on large-cap stocks, with a minimum allocation of 80 percent of assets in large-cap companies.

3. Large and Mid-Cap Fund

Who Should Invest

Investors desiring a balanced approach between large-cap stability and mid-cap growth.

Time Horizon

Medium to long-term investment horizon (3-5 years or more).

Risk

Moderate risk due to exposure to both large-cap and mid-cap stocks.Moderate risk due to exposure to both large-cap and mid-cap stocks.

An open-ended equity scheme that invests in both large-cap and mid-cap stocks, with a minimum of 35 percent allocated to mid-cap stocks.

4. Mid-Cap Fund

Who Should Invest

Investors seeking higher growth potential and willing to accept higher risk.

Time Horizon

A long-term horizon (5 years or more) is recommended.

Risk

Higher risk due to exposure to mid-cap stocks, which can be more volatile.

An open-ended equity scheme predominantly invested in mid-cap stocks, with at least 65 percent of assets allocated to mid-cap companies.

5. Small Cap Fund

Who Should Invest

Aggressive investors with a high-risk tolerance seeking substantial growth potential.

Time Horizon

A long-term horizon (5-7 years or more) is advisable.

Risk

High risk due to exposure to small-cap stocks, which can be highly volatile.

An open-ended equity scheme primarily invested in small-cap stocks, with a minimum allocation of 65 percent to small-cap companies.

6. Dividend Yield Fund

Who Should Invest

Investors seeking regular dividend income and moderate growth.

Time Horizon

A medium to long-term horizon (3-5 years or more).

Risk

Moderate risk associated with stock market fluctuations; income may be impacted by dividend trends.

An open-ended equity scheme primarily focused on dividend-yielding stocks, emphasizing investments in such stocks.

7. Value Fund or Contra Fund

Who Should Invest

Investors looking for undervalued stocks and willing to adopt a patient, contrarian approach.

Time Horizon

A long-term horizon (5 years or more) is ideal.

Risk

Moderate risk associated with value investing strategies; potential for prolonged periods of underperformance.

An open-ended equity scheme that follows a value investment strategy.

8. Focused Fund

Who Should Invest

Investors comfortable with concentrated portfolios and specific market segments.

Time Horizon

A long-term horizon (5 years or more).

Risk

Concentrated risk as investments are limited to a smaller number of stocks; returns can be influenced by the chosen focus.

An open-ended equity scheme that concentrates its investments in a maximum of 30 stocks, specifying its focus within the multi-cap, large-cap, mid-cap, or small-cap segment.

9. Sectoral/Thematic Fund

Who Should Invest

Investors with a strong conviction in a particular sector or theme and are willing to take sector-specific risks.

Time Horizon

A medium to long-term horizon (3-5 years or more).

Risk

High risk associated with sector-specific or thematic investments; returns linked to sector/theme performance.

An open-ended equity scheme that either specializes in a specific sector, such as banking or power (sectoral fund), or aligns its investments with a particular theme, like infrastructure, investing in companies related to infrastructure, construction, cement, steel, telecom, and power.

10. Equity Linked Savings Scheme (ELSS)

Who Should Invest

Tax-conscious investors seeking tax benefits under Section 80C and willing to invest in equities.

Time Horizon

A medium to long-term horizon (3-5 years or more).

Risk

Moderate to high risk due to equity exposure; lock-in period of 3 years

An open-ended equity-linked savings scheme with a mandatory lock-in period of three years, offering tax benefits.

What is Debt Schemes?

Debt schemes, also known as debt mutual funds, are investment options that primarily allocate capital to a diversified portfolio of fixed-income securities such as government and corporate bonds, treasury bills, and other debt instruments. These schemes aim to provide investors with a relatively stable and predictable source of income while preserving their invested capital. Debt schemes vary in terms of risk and return potential, offering options like liquid funds, short-term funds, and income funds, each with its own investment objective and risk profile. Investors can benefit from the liquidity, tax advantages, and diversification that debt schemes provide, making them a valuable component of a well-rounded investment portfolio.

1. Overnight Fund

Who Should Invest

Investors seeking a low-risk, highly liquid option for parking surplus funds overnight.

Time Horizon

Extremely short-term, usually one day.

Risk

Minimal credit risk due to the very short-term nature of investments, but returns are generally lower compared to longer-duration debt funds.

An open-ended debt scheme focuses on investing in overnight securities, characterized by a one-day maturity.

2. Liquid Fund

Who Should Invest

Individuals and businesses looking for a safe and highly liquid option for short-term cash management.

Time Horizon

Short-term, typically a few days to a few months.

Risk

Very low credit risk, but potential for slightly higher returns compared to overnight funds.

This open-ended liquid scheme directs investments into debt and money market securities, featuring maturities of up to 91 days.

3. Ultra Short Duration Fund

Who Should Invest

Investors with a short to medium-term investment horizon seeking higher returns than liquid funds.

Time Horizon

Short to medium-term, generally 3 to 6 months.

Risk

Low to moderate credit risk due to the slightly longer duration; returns are relatively higher but still stable.

Operating as an open-ended ultra-short term debt scheme, this fund concentrates on debt and money market instruments with Macaulay durations ranging from 3 to 6 months.

4. Low Duration Fund

Who Should Invest

Individuals and corporates looking for a conservative debt investment with slightly higher returns than liquid and ultra-short duration funds.

Time Horizon

Short to medium-term, typically 6 months to 1 year.

Risk

Low to moderate credit risk; potential for marginally higher returns than ultra-short duration funds.

An open-ended low-duration debt scheme emphasizes investments in debt and money market instruments exhibiting Macaulay durations between 6 months and 12 months.

5. Money Market Fund

Who Should Invest

Conservative investors seeking a short-term parking place for their funds.

Time Horizon

Short-term, generally up to 1 year.

Risk

Very low credit risk, making them suitable for short-term cash management.

This open-ended debt scheme focuses on money market instruments with maturities up to 1 year.

6. Short Duration Fund

Who Should Invest

Investors with a medium-term horizon looking for a blend of safety and relatively higher returns.

Time Horizon

Medium-term, generally 1 to 3 years.

Risk

Low to moderate credit risk, with potential for better returns than low duration funds.

As an open-ended short-term debt scheme, this fund invests in debt and money market instruments characterized by Macaulay durations ranging from 1 year to 3 years.

7. Medium Duration Fund

Who Should Invest

Investors with a medium-term horizon willing to accept slightly higher risk for potentially higher returns.

Time Horizon

Medium-term, typically 3 to 4 years.

Risk

Moderate credit risk, with potential for relatively better returns compared to short duration funds.

Operating as an open-ended medium-term debt scheme, this fund’s investments target debt and money market instruments with Macaulay durations falling between 3 and 4 years.

8. Medium to Long Duration Fund

Who Should Invest

Investors with a medium-term horizon willing to accept moderate risk for potentially higher returns.

Time Horizon

Medium-term, typically 4 to 7 years.

Risk

Moderate credit risk due to longer duration; potential for relatively better returns than medium duration funds.

This open-ended medium-term debt scheme concentrates on debt and money market instruments with Macaulay durations spanning from 4 to 7 years.

9. Long Duration Fund

Who Should Invest

Investors with a long-term horizon willing to accept higher risk for the possibility of higher returns

Time Horizon

Long-term, generally more than 7 years.

Time Horizon

Long-term, generally more than 7 years.

Risk

Higher credit risk due to the extended duration; potential for higher returns but subject to interest rate fluctuations

An open-ended debt scheme is designed for investments in debt and money market instruments characterized by Macaulay durations exceeding 7 years.

10. Dynamic Bond

Who Should Invest

Investors looking for a flexible debt fund that can adapt to changing market conditions and interest rate movements.

Time Horizon

Medium to long-term, with flexibility.

Risk

Moderate to high, as the fund can actively manage duration and credit risk; returns vary based on market conditions.

This open-ended dynamic debt scheme provides flexibility to invest across varying durations.

11. Corporate Bond Fund

Who Should Invest

Investors seeking higher returns than government securities with moderate credit risk.

Time Horizon

Medium to long-term.

Risk

Moderate credit risk; returns influenced by corporate bond performance.

An open-ended debt scheme predominantly allocates investments to AA+ and above rated corporate bonds, with a minimum of 80 percent of total assets dedicated solely to AA+ and above rated corporate bonds.

12. Corporate Bond Fund

Who Should Invest

Investors willing to accept higher credit risk for potentially higher returns.

Time Horizon

Medium to long-term.

Risk

High credit risk due to exposure to below highest-rated corporate bonds.

Operating as an open-ended debt scheme, this fund targets corporate bonds rated below the highest rating, with a minimum allocation of 65 percent of total assets to AA (excluding AA+ rated corporate bonds) and below rated corporate bonds.

13. Banking and PSU Fund

Who Should Invest

Conservative investors seeking higher returns than traditional bank deposits with relatively lower risk.

Time Horizon

Medium to long-term.

Risk

Low credit risk as investments are primarily in banking and PSU instruments.

This open-ended debt scheme predominantly invests in debt instruments issued by banks, Public Sector Undertakings, Public Financial Institutions, and Municipal Bonds.

14. Gilt Fund

Who Should Invest

Investors looking for safety and stability with investments in government securities.

Time Horizon

Medium to long-term.

Risk

Very low credit risk, but subject to interest rate fluctuations.

An open-ended debt scheme that focuses on investments in government securities across varying maturities.

15. Gilt Fund

Who Should Invest

Investors seeking protection against interest rate risk through investments in floating-rate instruments.

Time Horizon

Medium to long-term.

Risk

Low credit risk, but returns linked to interest rate movements.

This open-ended debt scheme predominantly invests in floating rate instruments, including fixed rate instruments converted to floating rate exposures using swaps and derivatives, with a minimum allocation in floating rate instruments.

What is Hybrid Schemes?

Hybrid schemes, also known as balanced funds, are a category of mutual funds that combine investments in equities (stocks) and fixed-income securities (bonds) to offer investors a diversified portfolio. These funds aim to balance risk and return by strategically allocating assets among different asset classes, catering to a wide range of risk tolerances and investment goals. Depending on their specific type, hybrid funds provide varying levels of growth potential and income stability. They are professionally managed and diversify across sectors and securities within their chosen asset classes, making them a convenient option for investors seeking a balanced and diversified approach to investing.

1. Conservative Hybrid Fund

Who Should Invest

Conservative investors seeking higher returns than traditional bank deposits with relatively lower risk.

Time Horizon

Medium to long-term.

Risk

Low credit risk as investments are primarily in banking and PSU instruments.

An open-ended hybrid scheme primarily allocates investments to debt instruments, constituting between 75 percent and 90 percent of total assets, while equity investments range from 10 percent to 25 percent of total assets.

2. Balanced Hybrid Fund

Who Should Invest

Investors looking for a well-rounded mix of equities and debt, providing a moderate risk-reward profile.

Time Horizon

Ideal for investors with a medium to long-term investment horizon.

Risk

Moderate risk due to balanced allocation, with potential for both equity and interest rate fluctuations.

This open-ended balanced scheme invests in both equity and debt instruments, with equity holdings ranging from 40 percent to 60 percent of total assets, and debt instruments making up a similar range, with no allowance for arbitrage.

3. Aggressive Hybrid Fund

Who Should Invest

Investors seeking higher growth potential with a moderate level of risk.

Time Horizon

Suitable for investors with a medium to long-term horizon.

Risk

Moderate to higher risk due to significant equity exposure; potential for market volatility.

Investments in equity and equity-related instruments make up 65 percent to 80 percent of total assets, while debt instruments constitute 20 percent to 35 percent.

4. Dynamic Asset Allocation or Balanced Advantage

Who Should Invest

Investors looking for flexibility in asset allocation to adapt to changing market conditions.

Time Horizon

Suitable for investors with varying time horizons, as it adjusts allocation dynamically.

Risk

Moderate risk, as it actively shifts between equity and debt; returns depend on market timing.

An open-ended dynamic asset allocation fund, with a flexible approach to managing investments in equity and debt.

5. Multi Asset Allocation

Who Should Invest

Diversification-focused investors seeking exposure to a broader set of asset classes.

Time Horizon

Suitable for investors with a medium to long-term horizon.

Risk

Diversified risk across multiple asset classes, with returns influenced by each asset’s performance.

This open-ended scheme diversifies across at least three asset classes, allocating a minimum of 10 percent to each, and does not treat foreign securities as a separate asset class.

6. Arbitrage Fund

Who Should Invest

Investors looking for low-risk opportunities with a focus on arbitrage strategies.

Time Horizon

Suitable for short to medium-term investors.

Risk

Low to moderate risk due to arbitrage strategies; returns are relatively stable but may not be high.

An open-ended scheme dedicated to exploiting arbitrage opportunities, with a minimum of 65 percent invested in equity and equity-related instruments.

7. Equity Savings

Who Should Invest

Investors seeking a blend of equity exposure, arbitrage opportunities, and debt stability.

Time Horizon

Ideal for investors with a medium to long-term horizon.

Risk

Moderate risk due to equity exposure; potential for stable returns from arbitrage and debt.

An open-ended scheme invests in equity, arbitrage, and debt, with at least 65 percent in equity and equity-related instruments and a minimum of 10 percent in debt.

What is Solution Oriented Schemes?

Solution Oriented Schemes, often referred to as Retirement Funds, are specialized mutual fund schemes tailored for long-term financial planning, particularly for retirement. These schemes are designed to encourage disciplined, systematic wealth accumulation over an extended period, typically until retirement age. With a focus on retirement needs, they often come with a lock-in period and may offer tax benefits in some regions. These funds employ dynamic asset allocation strategies, transitioning from equity to debt as retirement approaches, aiming to reduce risk. Solution Oriented Schemes serve as a vital financial planning tool, providing investors with options for retirement income and helping them achieve their long-term financial goals. To invest in these schemes, individuals should carefully assess their retirement objectives, risk tolerance, and the fund’s specific features and lock-in periods in their respective jurisdictions, seeking guidance from financial advisors when necessary.

1. Retirement Fund:

Who Should Invest

Individuals looking to systematically save for retirement and secure their financial future.

Time Horizon

Long-term; until retirement age or a minimum lock-in period of 5 years.

Risk

Generally moderate to high, as these funds may have an equity component. Risks decrease as retirement approaches due to asset allocation adjustments.

An open-ended solution-oriented retirement scheme with a lock-in period of 5 years or until the investor’s retirement age, whichever comes first.

2. Children’s Fund

Who Should Invest

Parents or guardians planning for their child’s future financial needs, such as education or marriage.

Time Horizon

Long-term; until the child attains the age of majority or a minimum lock-in period of 5 years.

Risk

Moderate to high, as these funds may have an equity component. Risks decrease as the child approaches the age of majority.

A Children’s Fund is a specialized financial product designed to help parents or guardians save and invest for their child’s future financial needs, such as education expenses or marriage. These funds often come with a lock-in period and systematic investment options, providing a disciplined approach to securing a child’s financial future.

3. Index Funds/Exchange Traded Fund:

Who Should Invest

Ideal for investors seeking passive market exposure through index tracking. Particularly suited for those who believe in efficient markets and prefer lower-cost investments.

Time Horizon

Suitable for long-term investors with horizons of at least five years, focusing on gradual wealth accumulation.

Risk

Offers relatively low risk compared to active funds but is exposed to market volatility. Returns closely mirror the underlying index, limiting potential for outperformance.

An open-ended scheme that replicates or tracks a specific index, with at least 95 percent of total assets invested in securities of the target index.

Fund of Funds (Overseas/Domestic)

Who Should Invest

Designed for those desiring diversified portfolios without the need for active management. Suited for investors seeking simplicity and a hands-off approach.

Time Horizon

Generally best for medium to long-term investors, typically five years or more.

Risk

Risk level tied to the performance of underlying funds and asset classes. May have slightly higher fees compared to direct investments. Understanding underlying fund choices and allocation strategy is crucial to assess risk.

An open-ended fund of fund scheme that invests in an underlying fund, with at least 95 percent of total assets allocated to the underlying fund.

Investors should match their risk tolerance, investment horizon, and financial goals when selecting a mutual fund category. Diversifying across different fund types can help manage risk within a portfolio. It’s advisable to consult a financial advisor for personalized guidance.

Disclaimer:

This blog/video is for educational purposes only and should not be considered financial advice. It is essential to conduct your own research and consult with a qualified financial advisor before making any investment decisions. Your personal financial situation, risk tolerance, and investment goals are unique, and this content may not be suitable for you. Please make informed decisions based on your specific circumstances and professional guidance.