In the dynamic realm of finance, the debt-equity ratio emerges as a critical metric, offering valuable insights into a company’s financial stability and risk profile. This crucial ratio, calculated by dividing a company’s total debt by its shareholder equity, unveils the proportion of borrowed funds versus owner-invested capital employed to finance operations.

The debt-equity ratio assumes particular significance in the burgeoning Indian economy, where a diverse array of industries, each with varying risk profiles and financing needs, coexists. Understanding the debt-equity ratio within this context is essential for investors, lenders, and financial analysts alike to make informed decisions.

What is Debt-to-Equity Ratio?

The Debt-to-Equity Ratio is a financial metric that helps assess the relative proportion of debt and equity used by a company to finance its assets. It’s a simple calculation that provides insights into the financial structure and risk profile of a business. The formula for calculating the Debt-to-Equity Ratio is:

Debt-to-Equity Ratio = Total Debt / Total Equity

The debt-to-equity ratio (D/E ratio) is a financial ratio that indicates the relative proportion of debt and equity used to finance a company’s assets. It is calculated by dividing a company’s total debt by its total shareholder equity. A higher D/E ratio indicates that a company has more debt financing relative to equity financing.

The D/E ratio is a measure of a company’s financial leverage. Leverage can be used to increase returns to shareholders, but it also increases the risk of financial distress. A company with a high D/E ratio is more likely to default on its debt obligations if it experiences financial difficulties.

Factors affect a company's D/E ratio

Here are some of the factors that can affect a company’s D/E ratio:

- Growth rate: Companies that are growing rapidly may need to take on more debt to finance their growth.

- Interest rates: Companies that are able to borrow at low interest rates may be more likely to take on debt.

- Access to capital: Companies that have access to equity financing may be less likely to take on debt.

- Risk tolerance: Companies with a higher risk tolerance may be more likely to take on debt.

What is the Ideal D/E ratio?

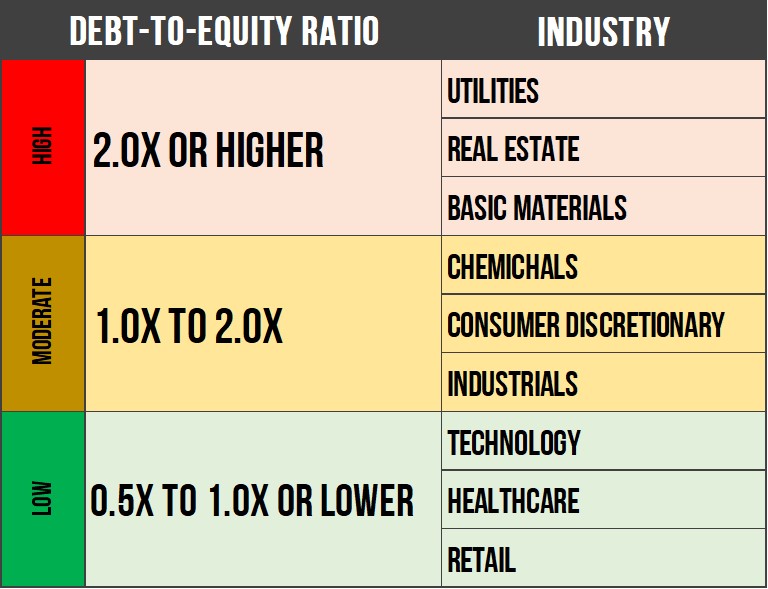

The ideal D/E ratio for a company varies depending on its industry, size, and risk profile. Here are the two important one should consider before comes to what should ideal debt-to-equity ratio of a company:

1. Industry norms:

The ideal debt-to-equity ratio for a company can vary significantly depending on the industry in which it operates. Companies in industries with more stable cash flows, such as utilities or consumer staples, can typically tolerate higher debt levels compared to companies in industries with more volatile cash flows, such as technology or infrastructure.

An analyst should compare a company’s debt-to-equity ratio to the average debt-to-equity ratio for its industry. If a company’s debt-to-equity ratio is significantly higher or lower than the industry average, it may be a sign of potential financial risk or opportunity.

2. Weighted average cost of capital (WACC):

The WACC is a measure of the overall cost of financing a company’s operations. It takes into account the cost of both debt and equity financing. A company’s debt-to-equity ratio has a significant impact on its WACC.

In general, a lower debt-to-equity ratio will lead to a lower WACC. This is because debt financing typically carries a lower cost than equity financing. However, excessive debt can also lead to higher interest expenses and financial risk, which could offset the benefits of a lower WACC.

An analyst should consider a company’s debt-to-equity ratio in the context of its WACC to assess the overall cost of its financing. A company with a lower debt-to-equity ratio and a lower WACC may be more attractive to investors compared to a company with a higher debt-to-equity ratio and a higher WACC.

Why choose a low D/E ratio company?

In the dynamic realm of finance, particularly in India, where the cost of financing is relatively high compared to other developed economies, opting for companies with lower debt-equity ratios can offer several advantages. By reducing their reliance on debt, these companies can minimize their exposure to interest rate fluctuations and maintain a healthier financial profile, ultimately enhancing their long-term sustainability and profitability.

Companies with lower debt-equity ratios are less vulnerable to financial risks and have greater flexibility to pursue growth opportunities. This makes them more attractive to investors, leading to better creditworthiness and improved dividend potential. In essence, choosing companies with lower debt-equity ratios is a prudent strategy for navigating the complexities of the Indian financial landscape.

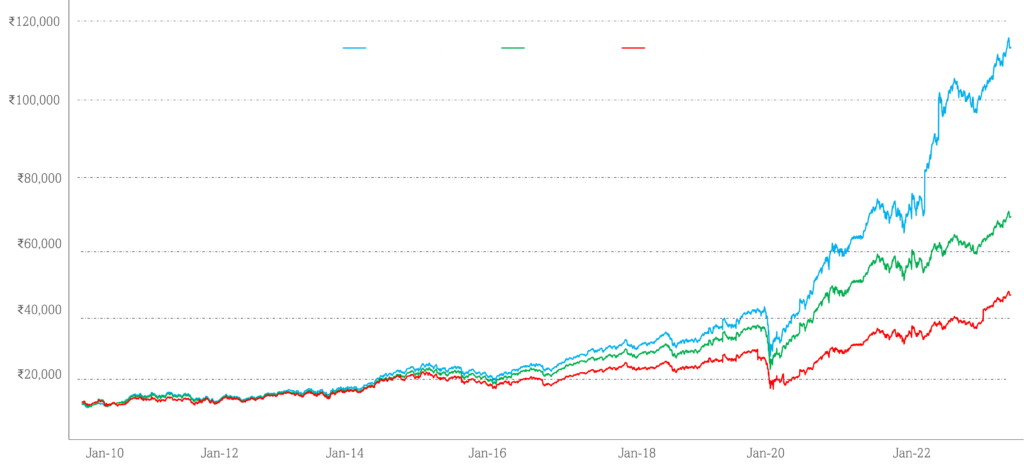

Low debt indicates a low risk of bankruptcy and a high likelihood of business continuity. The market tends to favor stocks of such companies in the long term. Substantiating this claim, my research, spanning two decades and involving an analysis of 1200 stocks, reveals that those with a low debt-to-equity ratio exhibit a Compound Annual Growth Rate (CAGR) of 15.21%. In contrast, the Nifty 50 Total Return stands at 11.86%. Conversely, stocks with a high debt-to-equity ratio show a growth of only 9.69%.

To illustrate, if an individual invested ₹10,000 in 2010, the value of their investment would have grown to ₹107,239 by September 2023 for low debt-equity stocks. Meanwhile, an investment in Nifty 50 would yield returns of ₹65,542, whereas high debt-equity ratio stocks would only grow to ₹47,133. Examining daily rolling returns, low debt-equity stocks exhibit growth at 16.64%, Nifty 50 at 11.43%, and high debt-equity ratio stocks at a meager 7.50%.

Considering risk, the volatility of low debt-to-equity ratio stocks is lower compared to both Nifty total return and high debt-to-equity ratio stocks. Below is the graphical representation of how your investment has increased if you invested in high-quality stocks with a low debt-to-equity ratio.

Unlock the secrets of selecting high-quality stocks and elevate your investment game! Dive into the world of smart investing by joining our Hybrid Investing Masterclass. Discover proven strategies and insights in our exclusive 3-hour live session. Ready to take control of your financial future? Secure your spot now by registering through the link below. Don’t miss out on this opportunity to master the art of hybrid investing!

Learn To Build Your Multi-bagger Portfolio Spending Only 15 Minutes Without Finance Knowledge Or Investing Experience Without Losing Your Mind And Money.

Disclaimer:

This blog/video is for educational purposes only and should not be considered financial advice. It is essential to conduct your own research and consult with a qualified financial advisor before making any investment decisions. Your personal financial situation, risk tolerance, and investment goals are unique, and this content may not be suitable for you. Please make informed decisions based on your specific circumstances and professional guidance.