With over 15 years of experience in the Indian stock market and an analysis of approximately 1200 stocks, I’ve uncovered a valuable insight. There are specific ratios that not only indicate high-quality businesses but also have a track record of delivering strong performance over time. These stocks have the potential to become multibaggers if invested in wisely and held in your portfolio. In this article, I’m excited to introduce you to my ‘E-Cubed Method‘ (Elimination, Evaluate, and Exceptional), which outlines a systematic approach to identify high-quality stocks with empirical evidence. Follow these steps to build a portfolio of winners.

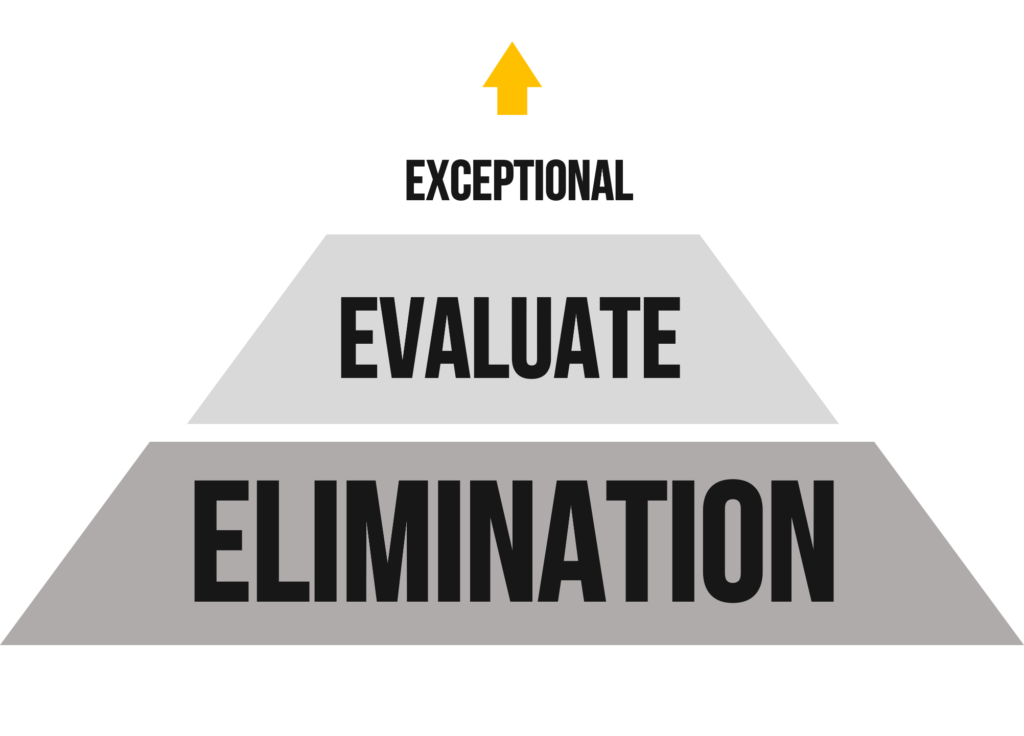

Let’s now explore our ‘E-Cubed Method,’ a three-step approach that simplifies stock selection. Following these steps carefully can significantly improve your chances of building a successful portfolio.

Step 1: ‘Elimination,’ we identify and eliminate certain stocks that display characteristics like losses, high debt, stock price volatility, or promoters with substantial pledged capital.

Step 2: ‘Evaluate,’ involves a deeper assessment of the remaining candidates, focusing on factors such as profitability, financial leverage, liquidity, and cash flow.

Step 3: ‘Exceptional Growth with Price-Action,’ we’ll create a watchlist of top-quality stocks, implement momentum filters, and employ a hybrid strategy for ongoing growth.

E-Cubed Method

Eliminate companies that are:

- Loss Making Companies

- High on debt

- High Volatility on Stock Price

- Promotors with High Pledged Capital

Evaluate companies based on:

- Quality and Consentient of profitability

- Leverage and solvency

- Operational Liquidity and Cash Flow Management

- Dividend Payout

Exceptional Growth Using Price-Action:

- Create a watchlist of 30-50 High-Quality Stocks

- Select based on Momentum Filter

- Rebalance based on Hybrid Strategy

Parameters for identifying multibaggers:

Cash Flow to Operating Profit

low idiosyncratic risk

Quality Management / Governance

Discovering potential multibagger stocks in India’s stock market involves looking at certain important things. Firstly, you want to find companies that are making more money over time, both in sales and profits. It’s like a sign that they are growing. Also, companies with low debt and a good record of paying dividends are safer bets. They should be good at managing their money too, so check if their cash flow is consistent. A low debt-to-equity ratio means they don’t owe a lot of money. And if they can turn their profits into cash easily, that’s even better. Lastly, it’s a good idea to spread your investments to different companies to reduce risks, and make sure the company is run by honest and capable people. By paying attention to these things, you can increase your chances of finding stocks that can grow a lot in the Indian market.

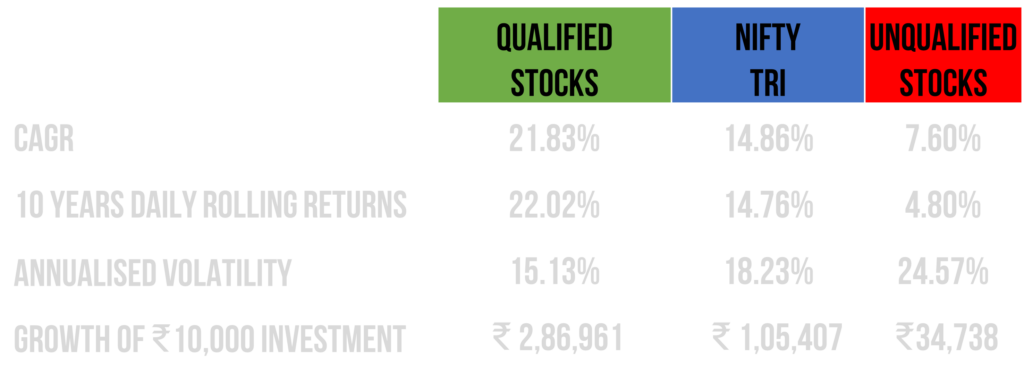

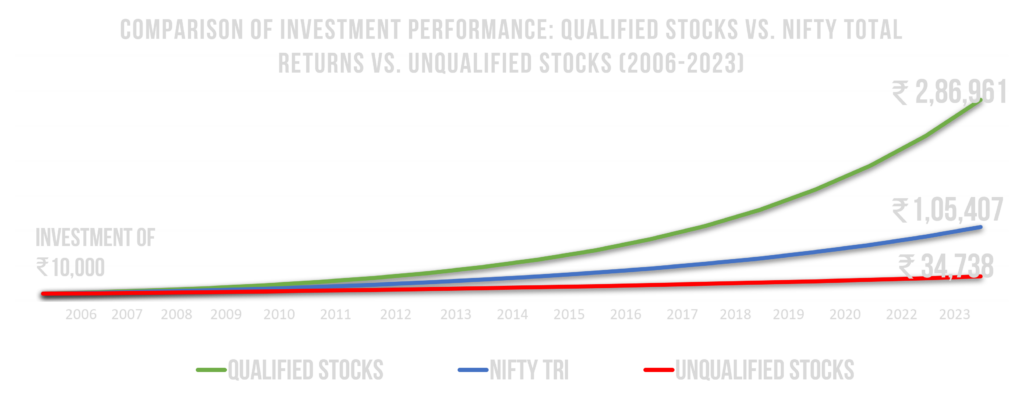

With my 15 years of experience, I’ve analyzed the performance of 1,200 stocks using specific criteria. I divided them into three groups: the first includes stocks that met all the criteria, the second comprises Nifty Total Returns Index (TRI), and the third consists of stocks that didn’t meet all the mentioned criteria.

In the dynamic and ever-evolving landscape of the Indian stock market, the quest for multibagger stocks demands not only keen observation but also a systematic approach. As we conclude our journey through this blog, we’ve explored essential criteria and methodologies for identifying stocks with the potential for exponential growth.

My ‘E-Cubed Method,’ emphasizing elimination, evaluation, and exceptional growth, serves as a guiding light in your pursuit. We’ve witnessed the power of robust top and bottom-line growth, high return on equity, and low price multiples ratios in selecting promising stocks. The importance of consistent dividend yield, operating cash flow, low debt-to-equity ratios, and efficient cash flow conversion has also been underscored.

Learn To Build Your Multi-bagger Portfolio Spending Only 15 Minutes Without Finance Knowledge Or Investing Experience Without Losing Your Mind And Money

Remember, investing carries inherent risks, and no approach guarantees success. However, armed with knowledge, diligence, and patience, you can significantly enhance your chances of identifying those stocks poised for remarkable growth. As you embark on your investment journey, keep these principles in mind, and may your portfolio be filled with the multibagger gems of tomorrow.

Happy investing!

Disclaimer:

This blog/video is for educational purposes only and should not be considered financial advice. It is essential to conduct your own research and consult with a qualified financial advisor before making any investment decisions. Your personal financial situation, risk tolerance, and investment goals are unique, and this content may not be suitable for you. Please make informed decisions based on your specific circumstances and professional guidance.