India’s economic trajectory is set to undergo a remarkable transformation, according to a recent report by S&P Global. The report, titled ‘Look Forward: India’s Money,’ projects that India has the potential to evolve into a $6.7 trillion economy by 2031, from its current $3.4 trillion. This growth is contingent upon sustaining an average annual growth rate of 6.7% over a span of 7 years. The report emphasizes the significance of capital accumulation and strategic reforms in shaping India’s economic landscape.

Economic Growth Projections

India’s GDP growth to average 6.7% per year from fiscal year 2024 to fiscal year 2031. If these projections materialize, it would lead to a substantial increase in GDP, reaching $6.7 trillion by 2031. This growth trajectory signifies the potential for a doubling of the economy in just 7 years. Moreover, the per capita GDP is expected to rise to approximately $4,500.

The Gross Domestic Product per capita in India was last recorded at $2085.12 US dollars in 2022. The GDP per Capita in India is equivalent to 17 percent of the world’s average. The GDP per Capita in India has shown an increasing trend, reaching an all-time high of $2085.12 USD in 2022 from a record low of $305.79 USD in 1960. The projections suggest that GDP per Capita in India is expected to reach $2210.00 USD by the end of 2023. It is further projected to trend around $2347.00 USD in 2024 and $2505.00 USD in 2025.

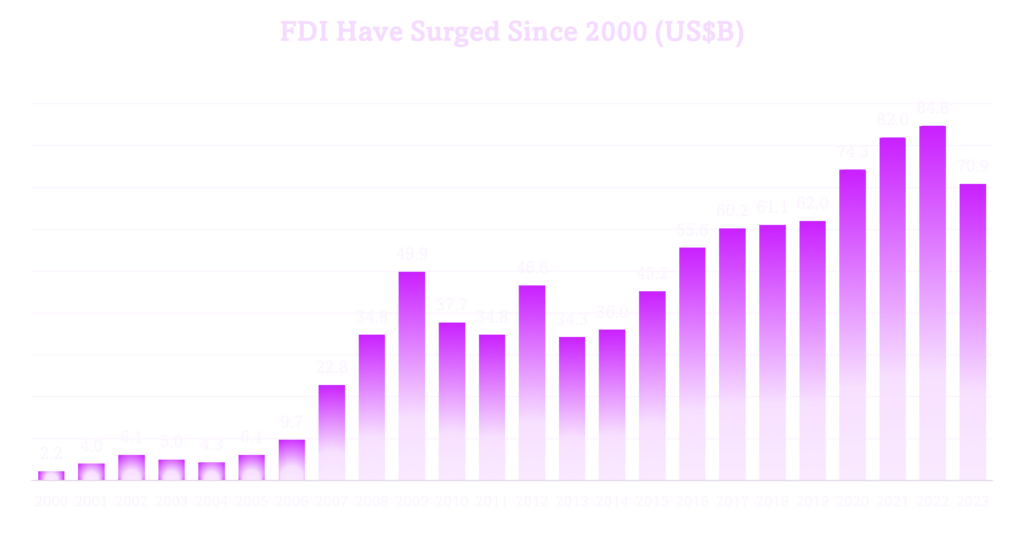

India's Soaring FDI Inflows: A Magnet for Multinationals and Economic Growth

India has emerged as an increasingly alluring destination for multinational corporations spanning diverse sectors. Notably, in the fiscal year 2022, the Ministry of Commerce and Industry reported an unprecedented surge in gross foreign direct investment (FDI) inflows, totaling $84.8 billion. Of particular significance, FDI inflows into the manufacturing sector experienced a remarkable 76% upswing, surpassing $21 billion during that year alone. This remarkable trajectory stands in stark contrast to the modest $4.3 billion FDI inflow witnessed in fiscal 2004. A significant transformation has been observed in technology-related FDI, which has evolved into a pivotal wellspring of investment. Illustratively, the computer software and hardware domain emerged as the principal beneficiary of FDI inflows throughout fiscal 2022.

Factors Influencing Growth:

The report identifies several critical factors that will play a pivotal role in driving India’s economic expansion:

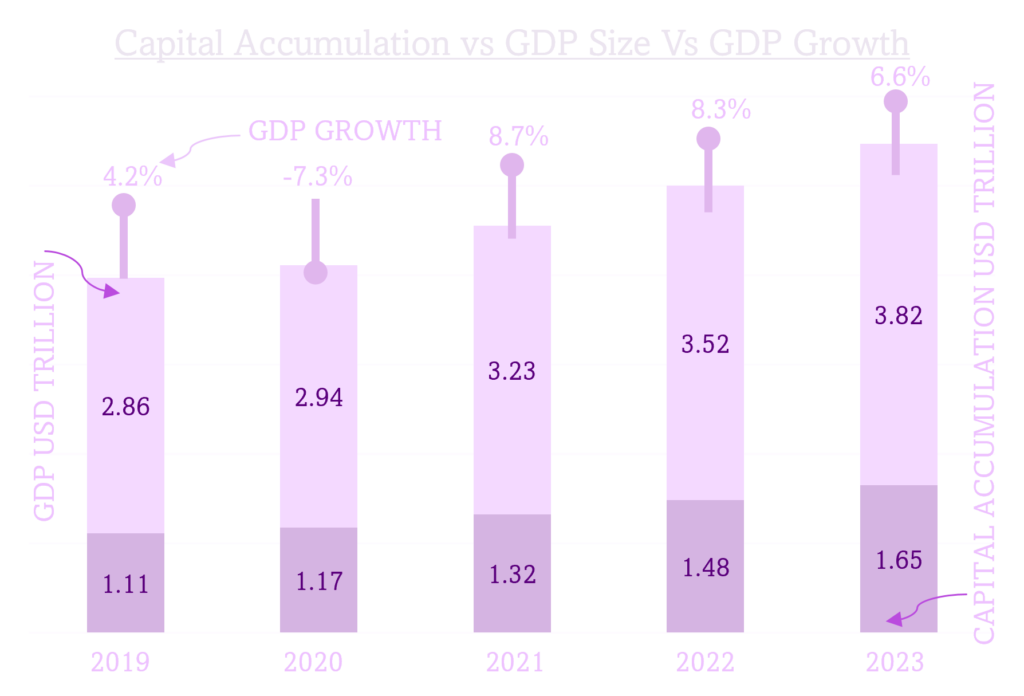

1. Capital Accumulation: The government, along with the private sector, is set to invest substantially in infrastructure and manufacturing. This concerted effort is expected to steer the economy towards a stable growth trend.

- First, infrastructure investments can help to improve the efficiency of the economy by reducing transportation costs and making it easier for businesses to operate.

- Second, manufacturing investments can help to create jobs and boost exports.

- Third, both infrastructure and manufacturing investments can help to improve the productivity of the economy, which can lead to higher wages and living standards.

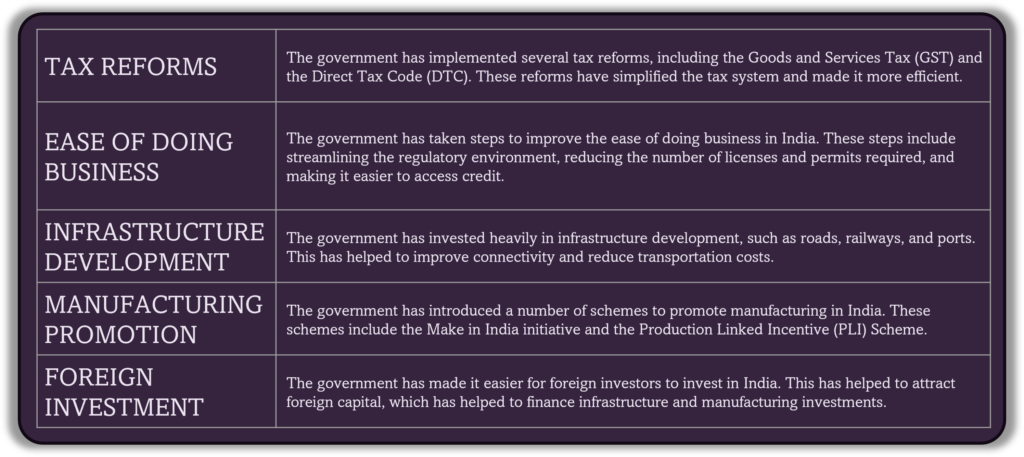

2. Reforms and Policies: The implementation of reforms such as the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code is anticipated to contribute positively to India’s economic growth. These reforms are expected to foster a healthier credit culture and facilitate ease of doing business.

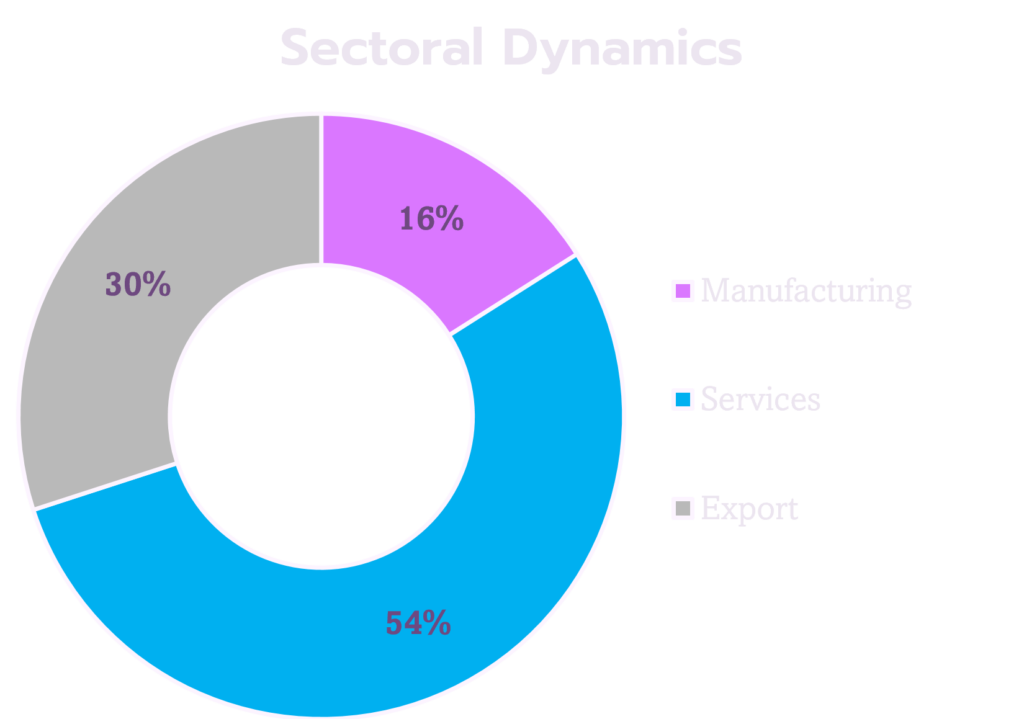

3. Sectoral Dynamics: While the nation is recalibrating towards manufacturing, the services sector is expected to maintain a robust presence in the economy. This balanced approach is likely to yield a favorable outcome.

Manufacturing: The manufacturing sector currently accounts for about 16% of India’s GDP. However, the government is targeting to increase this share to 25% by 2025. If this target is achieved, it would mean that the manufacturing sector would add an additional $1.5 trillion to the Indian economy.

Services: The services sector currently accounts for about 54% of India’s GDP. This is the largest sector in the Indian economy, and it is expected to continue to grow in the coming years. If the services sector continues to grow at its current pace, it would mean that it would add an additional $3 trillion to the Indian economy by 2025.

Exports: India’s exports have been growing steadily in recent years. In 2022, India’s exports were worth $400 billion. If exports continue to grow at their current pace, they would be worth $1 trillion by 2025

Challenges Ahead

Despite the promising projections, the report underscores the challenges that India must address to sustain its growth momentum:

1. Structural Reforms: The report highlights the need for structural reforms in three key areas: increasing labor force participation, particularly among women, enhancing skill development, boosting private investment in manufacturing, and improving external competitiveness through Foreign Direct Investment (FDI).

2. Cultural Transformation: As India pursues sustained growth, creating a conducive cultural environment becomes crucial. This entails fostering innovation, entrepreneurship, and adaptability to changing economic dynamics.

The S&P Global report paints an optimistic picture of India’s economic future, projecting substantial growth and transformation over the next decade. With strategic reforms, targeted investments, and a focus on enhancing competitiveness, India has the potential to ascend to the ranks of global economic powerhouses. The nation’s journey to a $6.7 trillion economy by 2031 is not without challenges, but with concerted efforts, India could realize this vision and secure a prosperous future.

Learn To Build Your Multi-bagger Portfolio Spending Only 15 Minutes Without Finance Knowledge Or Investing Experience Without Losing Your Mind And Money

Ride the wave of India’s skyrocketing GDP growth and amplify your investments through unprecedented FII and FDI inflows!

Uncover the Art of Swiftly Identifying Premium Stocks, Easier Than Brewing Your Morning Coffee. Join HYBRID INVESTING MASTERCLASS to know more about how to grow your investment in 10x in 10 years.

Disclaimer:

This blog/video is for educational purposes only and should not be considered financial advice. It is essential to conduct your own research and consult with a qualified financial advisor before making any investment decisions. Your personal financial situation, risk tolerance, and investment goals are unique, and this content may not be suitable for you. Please make informed decisions based on your specific circumstances and professional guidance.