In recent times, growing tensions between India and Pakistan have led to sharp movements in the stock markets. Many investors are worried, confused, and asking the important question: What happens to the market if India and Pakistan actually go to war?

Let’s break it down logically and calmly.

Immediate Impact: Panic and Market Fall

If a war were to break out, the Indian stock markets would likely see an immediate, sharp fall. Fear and uncertainty cause investors to panic, leading to a sell-off. Historically, during wars or rumors of wars, stock markets react negatively at first because investors rush to safeguard their investments.

However, it’s crucial to note that not every panic leads to a prolonged bear market.

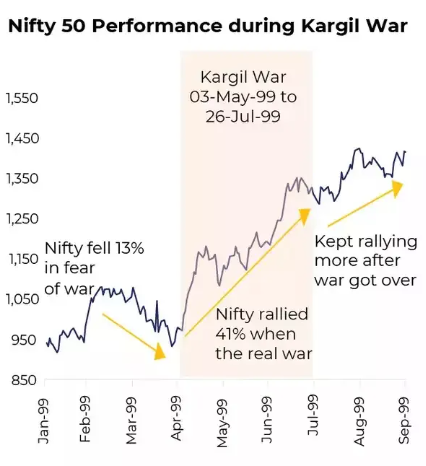

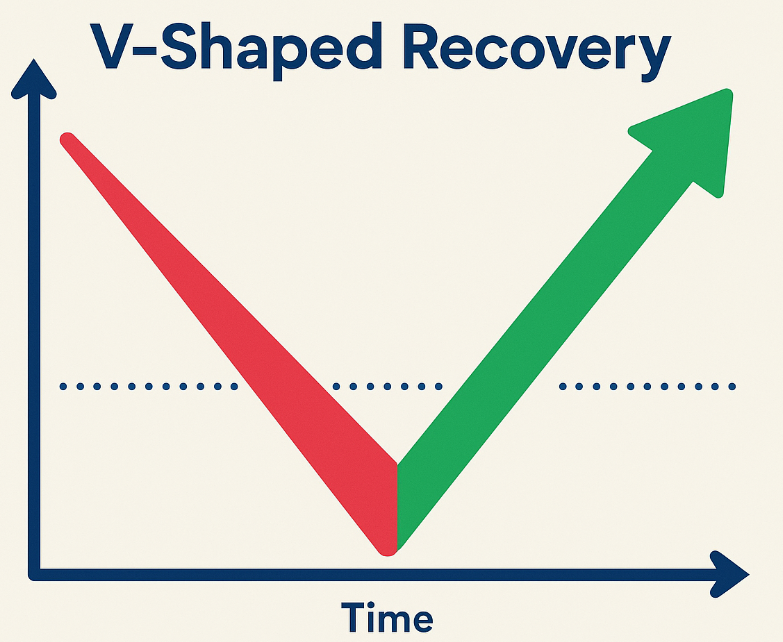

V-Shaped Recovery: The Historical Pattern

History shows us that markets often bounce back strongly after an initial fall. Whether it was the Kargil War, pandemics, or financial crises, Indian markets have typically followed a V-shaped recovery pattern. Investors who panic and sell during the initial drop often experience FOMO (Fear of Missing Out) once markets recover.

Thus, while the first reaction to war is negative, the medium- to long-term picture can quickly stabilize if the situation doesn’t escalate drastically.

The Scale of Conflict Matters

It’s important to differentiate between a direct war (like India-Pakistan) and wars where India is not involved (like Russia-Ukraine). A direct conflict would have a stronger, more adverse impact on Indian markets. Yet, if the skirmishes are limited, the market could recover faster than expected.

Economic Realities: Is Pakistan Ready for War?

Beyond emotions, we must look at economic logic. Pakistan’s total stock market capitalization is around ₹5.25 lakh crore — roughly equivalent to a single large Indian company’s market cap. Warfare is incredibly expensive: missile launches alone can cost lakhs per shot. Considering Pakistan’s struggling economy, sustaining a prolonged conflict seems financially unrealistic.

Thus, a full-fledged, long-term war is highly unlikely from an economic standpoint.

It’s important to differentiate between a direct war (like India-Pakistan) and wars where India is not involved (like Russia-Ukraine). A direct conflict would have a stronger, more adverse impact on Indian markets. Yet, if the skirmishes are limited, the market could recover faster than expected.

Current Correction: Healthy, Not Just War-Driven

The recent correction in the Indian markets isn’t purely because of war fears. After a non-stop rally from 21,800 to over 24,300 in Nifty, a correction was overdue. Healthy corrections are normal in bull markets and should not always be linked to geopolitical tensions.

Conclusion: Think Logically, Not Emotionally

While war fears are real and should not be dismissed, investors must approach the situation logically. Reacting emotionally by selling stocks can lead to missed opportunities when the market recovers. Historically, India has shown resilience, and barring a major escalation, markets could bounce back stronger than ever.

In times of uncertainty, staying calm, understanding the broader picture, and avoiding panic-driven decisions is the best strategy for any investor.